This post is also available in:

Bahasa Malaysia

A Balance Sheet is a financial statement that shows your business’s financial position at a specific point in time. Think of it like a snapshot of what your business owns, owes, and how much is left for you (the owner).

It has three main parts:

|

Section |

Description |

Example |

|

Assets |

What your business owns |

Cash, inventory, equipment |

|

Liabilities |

What your business owes |

Loans, unpaid bills |

|

Equity |

What’s left for the owner after paying off debts |

Retained profits, owner’s capital |

Why Should Business Owners Review It?

Here’s why it’s important, even for small businesses:

- Know Your Financial Health

– Are you growing or drowning in debt?

– Are your assets enough to cover your obligations? - Make Smarter Decisions

– Can you afford to expand?

– Is it time to cut down on expenses? - Build Trust with Others

– Banks or investors may ask to see your balance sheet before giving loans or funding. - Stay Compliant

– For Malaysian Sdn Bhd companies, balance sheets are part of your annual financial statements.

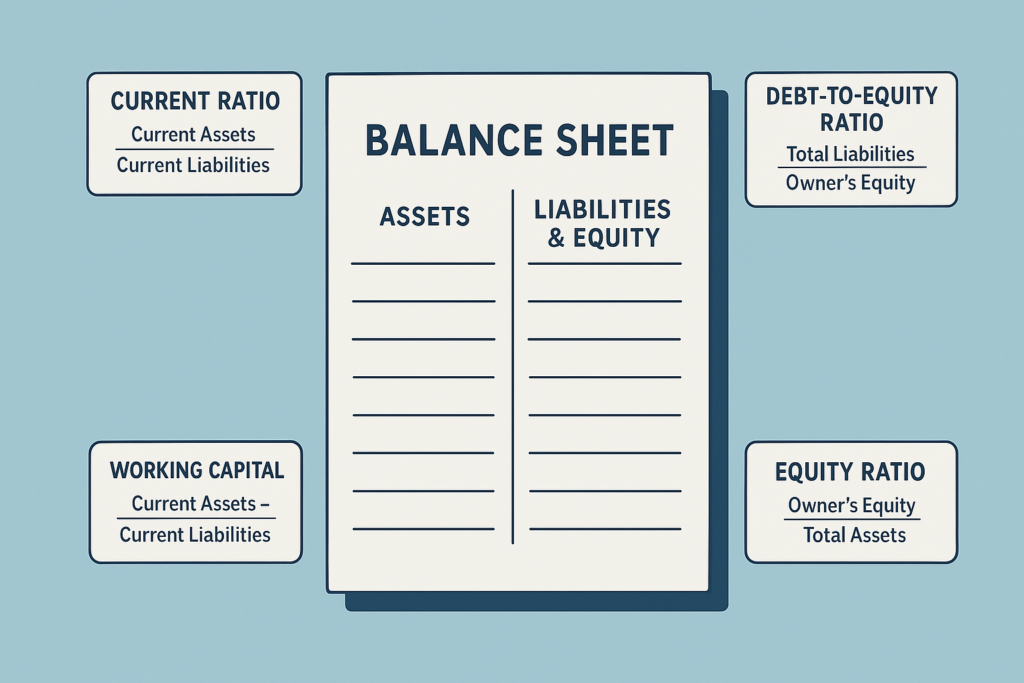

Key Ratios You Can Calculate from the Balance Sheet

Here are some simple but powerful ratios you can use to understand your business better:

1. Current Ratio

Formula:

Current Assets ÷ Current LiabilitiesWhat it means:

- Measures your ability to pay short-term bills.

- If it’s >1, you’re generally in a good position.

- If it’s <1, you might struggle to pay debts.

Example:

If your current assets are RM100,000 and liabilities are RM50,000, your ratio is 2.0 – very healthy.

2. Debt-to-Equity Ratio

Formula:

Total Liabilities ÷ Owner’s EquityWhat it means:

- Shows how much of your business is financed by debt vs. your own money.

- A high ratio (>2) could mean high risk, especially during tough times.

Example:

If you have RM200,000 in liabilities and RM100,000 in equity, the ratio is 2.0 – meaning you’re relying heavily on borrowing.

3. Working Capital

Formula:

Current Assets – Current LiabilitiesWhat it means:

- The amount of cash or liquid assets you have after paying short-term debts.

- Positive working capital = smooth operations.

4. Equity Ratio

Formula:

Owner’s Equity ÷ Total AssetsWhat it means:

- Tells you what portion of the business is truly yours (not financed by debt).

- Higher is better for long-term stability.

What Should Business Owners Do?

- Review your balance sheet at least quarterly.

- Compare ratios over time to spot trends.

- Use it to plan: buying equipment, taking loans, or cutting expenses.

- Discuss with your accountant or advisor to interpret results and set goals

Automatic Reports, Smarter Decisions

You don’t need to worry about how to prepare a Balance Sheet —our solution does that for you automatically.

All you need is a clear understanding of what the numbers mean, so you can make confident decisions to manage and grow your business effectively.

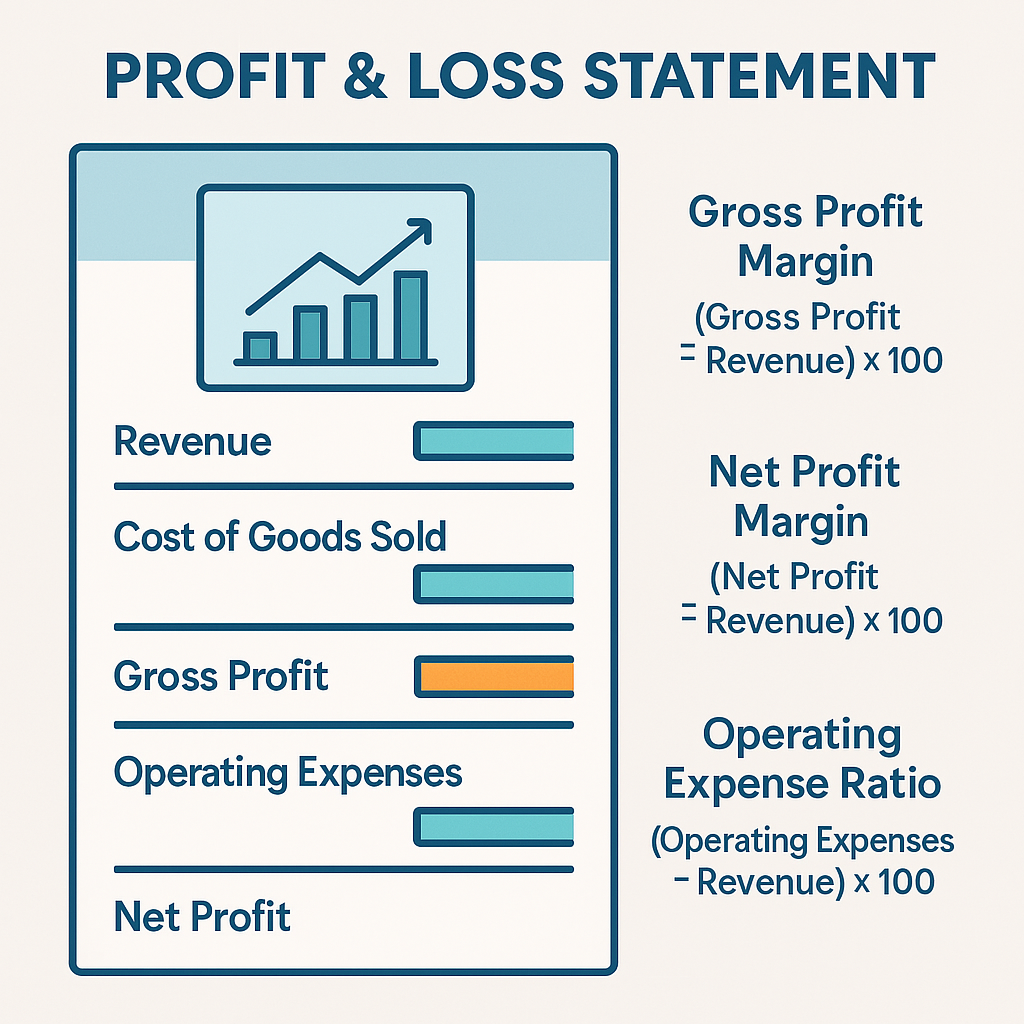

What is a Profit and Loss (P&L) Statement?

the Profit & Loss Statement is a financial report that shows your business’s revenue, expenses, and profit or loss over a specific period — usually monthly, quarterly, or yearly.

Key Metrics Every Business Should Monitor for Success

Key metrics, often referred to as Key Performance Indicators (KPIs), provide critical insights into your business’s health and help you make informed decisions.