This post is also available in:

Bahasa Malaysia

Malaysia is progressively rolling out its e-Invoicing mandate, a significant step towards digitizing the nation’s tax administration and enhancing efficiency. Recognizing the monumental shift this entails for businesses, the Inland Revenue Board of Malaysia (LHDN) has introduced a crucial “transition period” or “relaxation period” for each phase of implementation. This period is designed to provide businesses with the necessary flexibility to adapt their systems and processes before full enforcement takes effect.

What Does the Transition Period Mean?

The transition period is a six-month grace period granted to businesses immediately following their mandatory e-Invoicing implementation start date. During this time, the LHDN adopts a more lenient approach to compliance, offering several key flexibilities:

- Consolidated E-Invoices for All Transactions

Perhaps the most significant relief during this period is the allowance for businesses to issue consolidated e-invoices for all transactions, including Business-to-Business (B2B), Business-to-Consumer (B2C), and even self-billed e-invoices. This means that instead of generating a separate e-invoice for every single transaction, businesses can group multiple transactions into a single e-invoice, provided it is submitted to the LHDN within seven calendar days after the end of the month. - Relaxed Product/Service Descriptions

Businesses are permitted to use more flexible or general descriptions for products and services in their e-invoices, rather than requiring highly detailed line items. - No Penalties for Non-Compliance (with conditions)

Crucially, during this six-month window, the LHDN will not impose penalties under Section 120 of the Income Tax Act 1967 for non-compliance with e-Invoicing rules. This exemption is contingent on businesses, at the very least, complying with the requirement to issue consolidated e-invoices within the stipulated timeframe. - Buyer Requests for E-Invoices

Even if a buyer requests a separate e-invoice for a specific transaction, the supplier is allowed to issue only a consolidated e-invoice during this period.

What are Businesses Required to Do?

Despite the flexibility offered, businesses are still expected to take proactive steps towards full e-Invoicing compliance during their respective transition periods. Key requirements and recommendations include:

- Adhere to the Consolidated E-Invoice Schedule

Even if individual e-invoices aren’t mandated, businesses must still submit consolidated e-invoices for all transactions within seven calendar days after month-end. This is a critical baseline requirement to avoid penalties during the relaxation period. - Assess and Upgrade Systems:

Businesses should use this time to evaluate their existing accounting and invoicing systems. This may involve upgrading current software, implementing new e-Invoicing solutions, or integrating their systems with the LHDN’s MyInvois Portal via API. - Train Staff

Comprehensive training for staff on the new e-Invoicing processes, data requirements, and compliance obligations is essential for a smooth transition. - Digitize Data

Ensuring supplier and customer master data is digitized and accurate will streamline the e-Invoicing process. - Understand Implementation Timelines

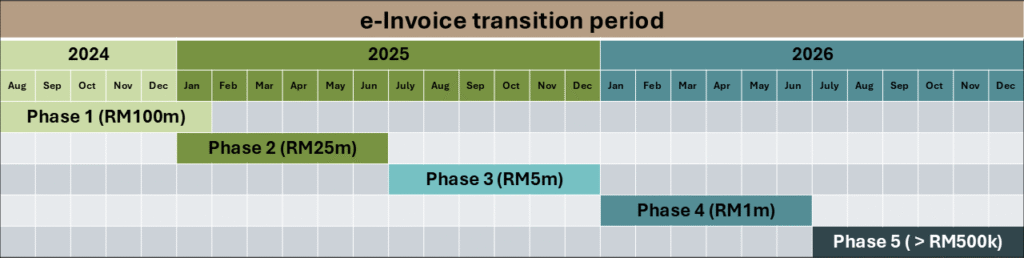

Businesses must be aware of their specific mandatory e-Invoicing start date based on their annual turnover or revenue for financial year ending 2022. The phased implementation schedule is as follows:- Phase 1

Mandatory from August 1, 2024

Taxpayers with annual turnover or revenue exceeding RM100 million. Relaxation Period: August 2024 – January 2025 - Phase 2

Mandatory from January 1, 2025

Taxpayers with annual turnover or revenue between RM25 million and RM100 million.

Relaxation Period: January 2025 – June 2025 - Phase 3

Mandatory from July 1, 2025

Taxpayers with annual turnover or revenue exceeding RM5 million up to RM25 million.

Relaxation Period: July 2025 – December 2025 - Phase 4

Mandatory from January 1, 2026

Taxpayers with annual turnover or revenue exceeding RM1 million up to RM5 million.

Relaxation Period: January 2026 – June 2026 - Phase 5

Mandatory from July 1, 2026

Taxpayers with annual turnover or revenue up to RM1 million, excluding those below RM500,000 who are currently exempted.

Relaxation Period: July 2026 – December 2026

- Phase 1

Exception to Consolidated e-Invoices During This Period

During the six-month relaxation period, the general rule is that businesses are allowed to issue consolidated e-invoices for all transactions, regardless of whether a buyer requests a separate e-invoice. This is a significant concession to ease the burden on businesses during the initial transition.

However, it is important to note that after the transition period ends for each respective phase, full compliance with individual e-invoicing for each transaction will be required. For example, for businesses in Phase 1 (annual turnover > RM100 million), the relaxation period ended on January 31, 2025, meaning they must now comply with full e-invoicing requirements, including separate e-invoices for B2B transactions.

Furthermore, a critical update for the later phases (starting from January 1, 2026, for taxpayers in Phase 4 onwards) is that businesses must issue individual e-invoices for every sale of goods or provision of services exceeding RM10,000, and consolidated e-invoicing will no longer be permitted for such transactions.

The transition period provided by LHDN is a strategic move to facilitate a smoother adoption of e-Invoicing across Malaysia. Businesses should leverage this flexibility to thoroughly prepare, ensuring their systems, processes, and staff are ready for the full mandate to avoid future penalties and reap the benefits of digital tax administration.