This post is also available in:

Bahasa Malaysia

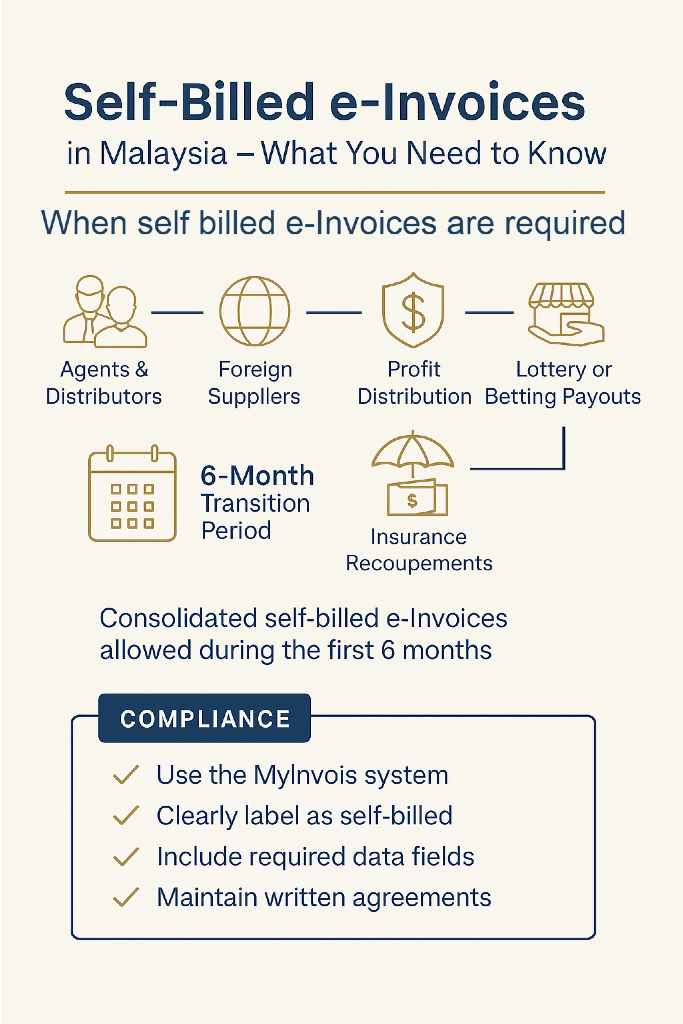

A self‑billed e‑invoice is an invoice prepared by the buyer instead of the supplier. It must be generated using the MyInvois system, include all required fields, and be submitted to Lembaga Hasil Dalam Negeri (LHDN). This is applicable in cases where the seller is unable or not required to issue an e-Invoice—especially for certain industries and cross-border transactions.

Update: Consolidated Self-Billed e-Invoices Allowed During Transition

To ease the burden of compliance during the initial stages of implementation, LHDN has announced that businesses are allowed to submit consolidated self‑billed e‑invoices during a 6‑month transition period from their respective implementation date.

This means that:

- Businesses required to commence e-Invoicing on 1 August 2024 may issue monthly or periodic consolidated self-billed e-Invoices up until 31 January 2025.

- After the transition period, businesses must submit individual self-billed e-Invoices per transaction, unless otherwise permitted by LHDN.

This provides businesses with greater flexibility as they adapt their systems and processes during the early phase of adoption.

When Is a Self‑Billed Invoice Required?

Self-billed e-invoices apply in the following situations:

- Payments to Agents, Dealers & Distributors

Businesses issue self-billed invoices to account for commissions or purchase of goods/services from appointed agents or intermediaries. - Purchases from Foreign Suppliers

When buying from non-resident suppliers who are not required to issue Malaysian e-Invoices, the local buyer must self-bill. - Profit Distribution to Investors

Where a business distributes profits, investment returns, or payouts (e.g. crowdfunding, REITs), self-billing is used to document the transaction. - E-Commerce Platforms

Marketplaces that facilitate sales on behalf of sellers may issue self-billed invoices to standardize record-keeping. - Betting, Lottery or Gaming Payouts

Companies managing betting or lottery platforms issue self-billed invoices when disbursing winnings. - Insurance Claims and Recoupments

Where reimbursements are issued or collected on behalf of policyholders, insurers may issue self-billed invoices for the amount recouped.

Key Compliance Requirements

- Buyer must issue the invoice using the MyInvois system.

- The invoice must clearly indicate that it is self-billed.

- All required data fields must be filled out (e.g., buyer & supplier details, SST status, invoice value).

- A written agreement between the buyer and supplier is recommended, where applicable.

- During the 6-month transition period, consolidated self-billed invoices are allowed.

- After the transition period, individual self-billed invoices per transaction must be issued unless otherwise permitted.

Summary Table

| Transaction Type | Who Issues Invoice | Self-Billing Reason |

|---|---|---|

| Payment to agents/distributors | Buyer | Seller is intermediary |

| Purchase from foreign suppliers | Buyer | Supplier not under MyInvois |

| Profit distribution | Buyer/distributor | Tracks payout or returns |

| E-commerce platform sales | Platform (buyer) | Standardized seller recordkeeping |

| Betting/lottery payouts | Platform/agent | Documentation of winnings |

| Insurance recoupment | Insurer | Tracks reimbursements |

Final Thoughts

Self-billed e-Invoices are not just a technicality—they’re a critical compliance tool under Malaysia’s expanding e-Invoicing regime. With the 6-month transitional allowance for consolidated invoicing, businesses have a unique opportunity to streamline their reporting process and prepare for full transaction-level invoicing ahead.

If your business engages with agents, foreign suppliers, investors, or platform sellers, now is the time to plan how self-billing will be managed in your accounting or ERP system.

Need guidance or a compliant solution? At Adventus Business Consult, we help Malaysian businesses simplify and automate their journey into e-Invoicing — including self-billed and consolidated workflows.