Running a small business? Then you’ve probably come across the terms accrual accounting and cash accounting. These are two different ways to track your income and expenses — and choosing the right one can make a big difference in how well you understand your business finances.

Let’s break it down in plain English.

What is Cash Accounting?

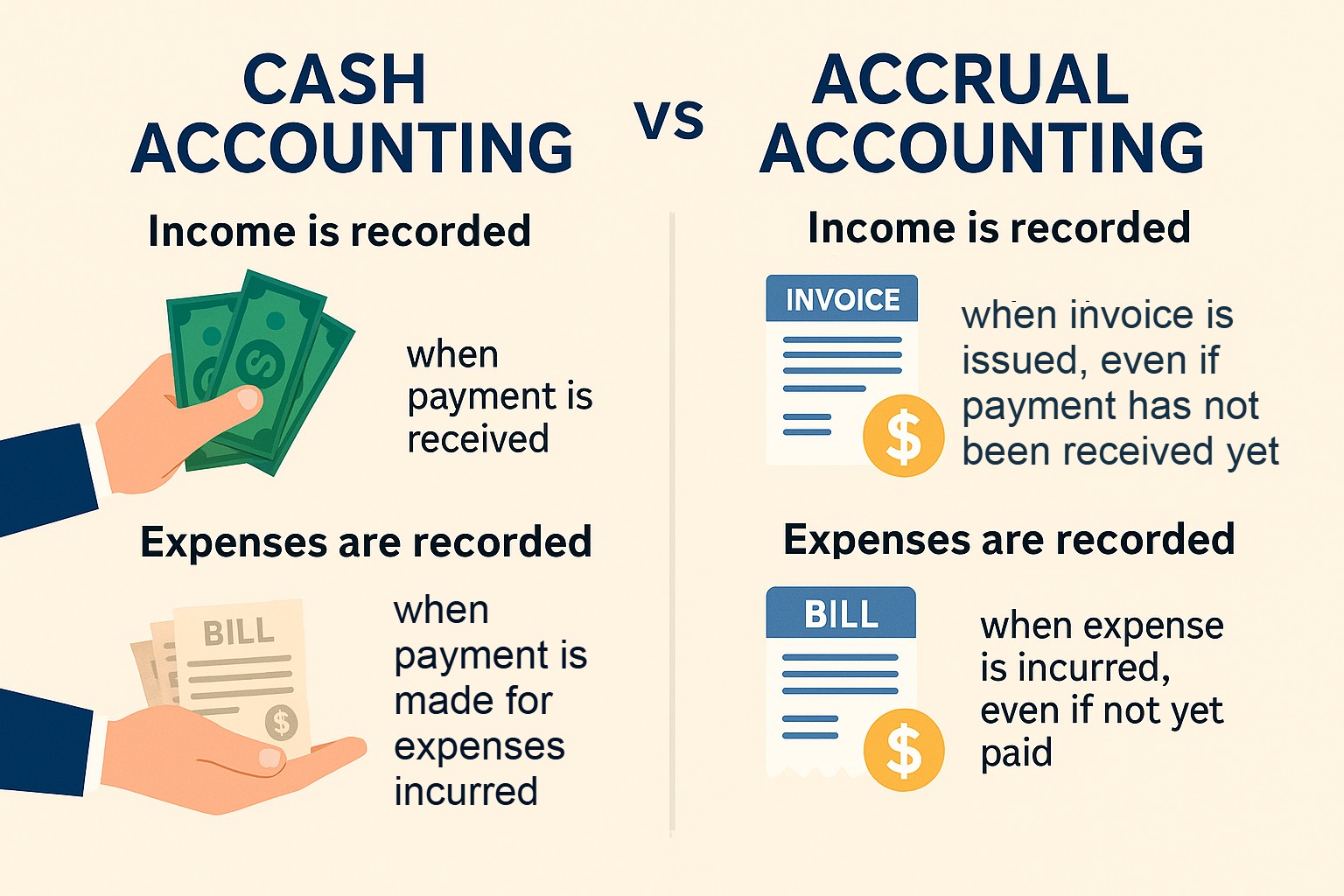

Cash accounting is the simplest method. You only record income when you actually receive money, and you only record expenses when you actually pay money out.

Example:

- You issue a sales invoice in June but only get paid in July. In cash accounting, that income is recorded in July.

- You receive a supplier’s bill in June but pay it in August. The expense is recorded in August.

Cash Accounting pros and cons

|

Pros |

Cons |

|---|---|

|

|

This method is like checking your wallet: You’re only concerned with what cash you have on hand right now.

What is Accrual Accounting?

Accrual accounting is a bit more advanced. You record income when it is earned, even if the money hasn’t come in yet. Likewise, you record expenses when they are incurred, even if you haven’t paid them yet.

Example:

- You issue a sales invoice in June, but the customer pays in July. That income is still recorded in June.

- You get a supplier’s bill in June for services used that month. Even if you pay it in August, the expense is still recorded in June.

This method gives a more accurate picture of how your business is performing, even if the bank account doesn’t reflect it yet.

Accrual Accounting pros and cons

|

Pros |

Cons |

|---|---|

|

|

So, Which Should You Choose?

- Small, cash-based businesses (like freelancers or small retailers):

Cash accounting might be all you need. - Growing businesses with credit terms, invoices, or inventory:

Accrual accounting is a better fit and often required once you hit a certain size.

In summary

Choosing the right accounting method helps you make smarter financial decisions. If you’re unsure which method suits your business best, contact us. We help Malaysian small businesses set up and manage their accounts in the most efficient way possible.

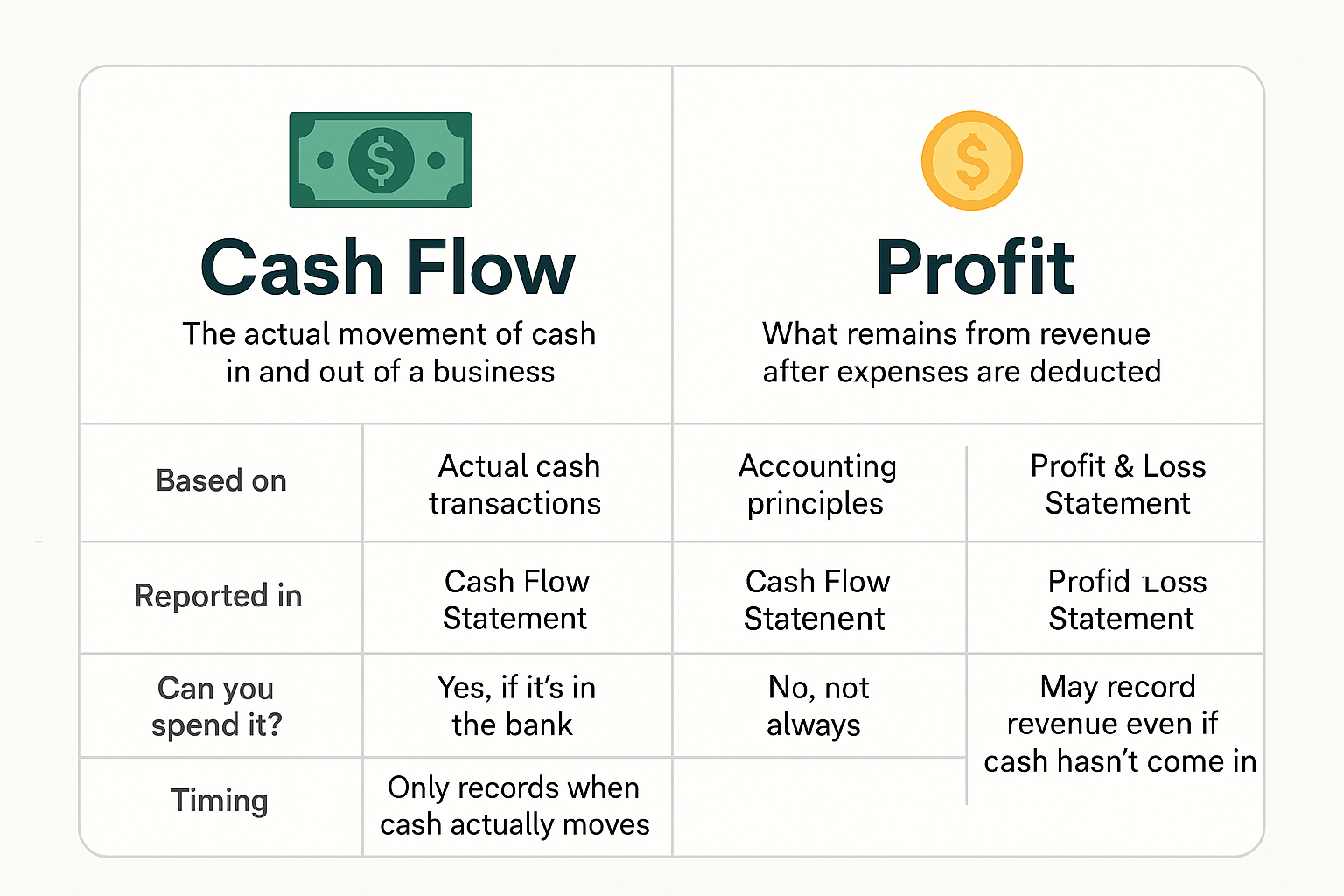

Cash Flow vs Profit: What Every SME Must Know

Running a small business in Malaysia isn’t easy. You wear many hats—from sales to operations to finance. And when it comes to financial health, one common mistake many SME owners make is confusing profit with cash flow.