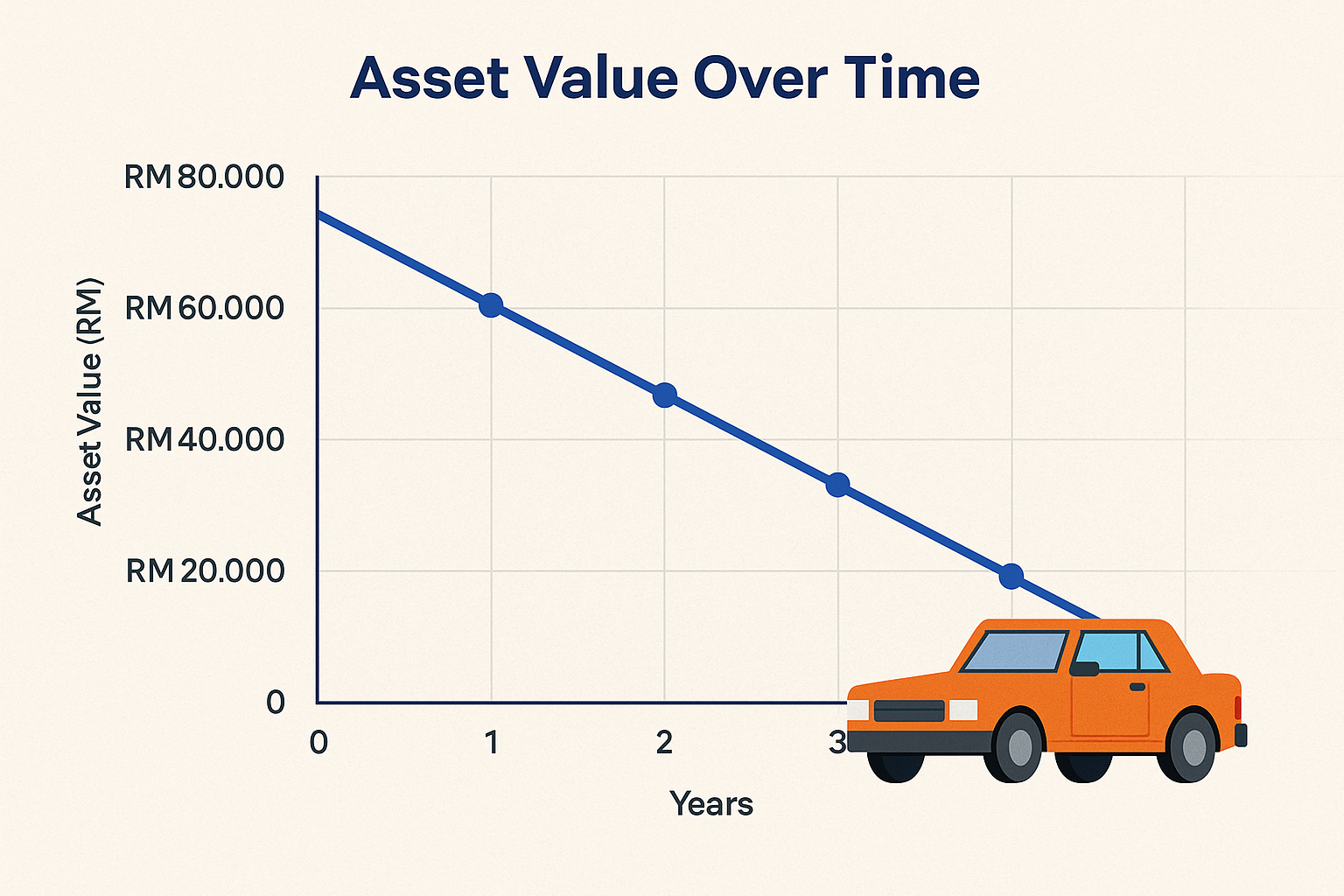

Imagine you buy a new car for your business. Over time, the value of that car drops because of wear and tear. That gradual loss in value is called depreciation.

In simple terms, depreciation is how businesses account for the declining value of their assets over time.

Why Does Depreciation Matter?

Depreciation is more than just a concept—it’s a crucial part of your financial statements. Here’s why it matters:

1. Accurate Profit Reporting

If you buy a RM50,000 machine and record the full amount as an expense in the first year, your profit for that year might look much lower than it really is. Depreciation spreads the cost of that machine over its useful life—say, five years—so your accounts show a more accurate picture of your yearly profits.

2. Tax Deduction

Depreciation is a non-cash expense. That means you’re not actually paying money every year, but you still get to deduct it from your profit to reduce taxable income. That’s a legal and fair way to lower your business taxes.

3. Asset Management

Depreciation helps track how much value is left in your business assets. That’s useful when deciding whether it’s time to repair, replace, or upgrade equipment.

Common Examples of Depreciation

|

Asset |

Cost (RM) |

Useful Life (Years) |

Annual Depreciation (RM) |

|---|---|---|---|

|

Laptop |

RM3,000.00 |

3 |

RM1,000.00 |

|

Delivery Van |

RM80,000.00 |

5 |

RM16,000.00 |

|

Office Furniture |

RM10,000.00 |

10 |

RM1,000.00 |

|

Photocopier |

RM12,000.00 |

4 |

RM3,000.00 |

These are based on the straight-line depreciation method, the simplest method where you divide the cost equally over the asset’s useful life.

How is Depreciation Shown in Financial Statements?

1. Profit & Loss Statement (Income Statement)

Depreciation appears as an expense, reducing your profit for the year.

2. Balance Sheet

The asset is shown at its original cost, and then accumulated depreciation (total depreciation over an asset’s life) is subtracted to show its current value (called net book value).

An example

Let’s say you bought an air conditioner for your office for RM5,000 and it’s expected to last 5 years.

Each year, you record RM1,000 as depreciation.

This helps you:

- Show more realistic profits each year

- Claim a tax deduction without actually spending more cash

- Keep track of how long the asset has left before needing replacement

In summary

Depreciation may sound like an accounting term for accountants, but understanding it helps business owners make smarter financial decisions. It’s a way to match your income with the actual cost of doing business and to manage your assets wisely.

Here’s the good news!

Managing fixed assets and depreciation doesn’t have to be complicated.

With our cloud accounting solutions, these processes are automated and seamlessly integrated—saving you time and ensuring accuracy.

And with expert advisory support from Adventus Business Consult, you’ll always have guidance to make informed decisions and stay compliant.

Let the system, and our expertise, do the heavy lifting. Contact us today to learn more.