This post is also available in:

Bahasa Malaysia

Running a small business in Malaysia often means juggling multiple responsibilities—from keeping customers happy to managing employees and ensuring compliance with statutory bodies. One area that can quickly get out of hand is expenses. If not tracked properly, small leaks in spending can add up to big losses.

That’s where Xero’s expense management features come in. Xero makes it easy for business owners and their teams to record, track, and manage every ringgit spent, so you can focus on growing your business.

Why Expense Management Matters

For many SMEs, expenses often go unmonitored until it’s too late. Without proper tracking, you risk:

- Overspending and cash flow issues

- Missing tax-deductible claims

- Incomplete records for compliance (e.g., LHDN audits)

- Difficulty reimbursing staff correctly

By managing expenses in Xero, you get real-time visibility and control—helping you make smarter business decisions.

Key Features of Xero Expense Management

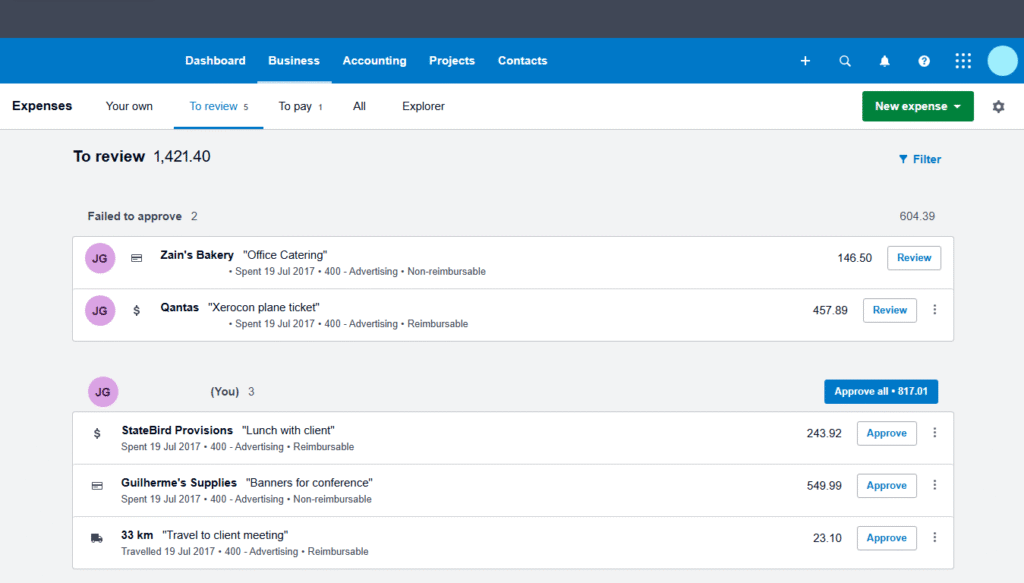

1. Submit and Approve Claims Anywhere

Employees can easily snap photos of receipts with the Xero Expenses app, and submit claims directly. Business owners or managers can then review and approve these expenses anytime, anywhere—even from a smartphone.

Benefit for SMEs: No more chasing physical receipts or dealing with delays.

2. Track Business Spending in Real Time

Every expense submitted flows straight into your Xero dashboard. You can instantly see how much has been spent, who spent it, and on what.

Benefit for SMEs: Real-time insights mean you’ll never be caught off guard by surprise expenses.

3. Simplified Reimbursements

Approved expenses can be reimbursed directly through Xero, reducing errors and ensuring employees are paid back quickly.

Benefit for SMEs: Keeps employees motivated and reduces friction in expense claims.

4. Automatic Accounting Entries

When expenses are submitted, Xero automatically codes them into your accounts—saving time and ensuring accuracy.

Benefit for SMEs: Less manual work, fewer errors, and reliable data for reporting.

5. Integrated with e-Invoicing Compliance

As Malaysia moves into LHDN e-Invoice phases, recording expenses correctly ensures your business stays compliant. Every approved expense can be tracked and reported, making your tax season easier and less stressful.

Best Practices for Managing Expenses in Xero

- Encourage Staff to Submit Immediately

Remind employees to snap and upload receipts the moment they spend company money. - Use Categories Wisely

Create categories (e.g., travel, meals, office supplies) to see where your money goes. - Set Approval Rules

Assign different approvers for different levels of expenses to keep control. - Review Reports Regularly

Use Xero’s reporting features to spot spending patterns and cut unnecessary costs.

Managing expenses doesn’t have to be complicated. With Xero, SMEs in Malaysia can streamline expense tracking, ensure compliance, and maintain healthy cash flow.

When your expenses are under control, you can focus on what matters most—growing your business.

More on Xero

- Why Xero Works for Small Businesses in Malaysia

- Xero Business Snapshot: Your Financial Dashboard

- Xero Security: Protecting Your Financial Data

- Xero Syft: Smarter Accounting for Malaysian SMEs

- Xero’s Watchlist feature

- Xero and LHDN E-Invoicing: Preparing for Malaysia’s Phase 4 in 2026

- Xerocon Brisbane 2025: How Xero’s AI, Analytics, and Smarter Tools are Supercharging Small Businesses