This post is also available in:

Bahasa Malaysia

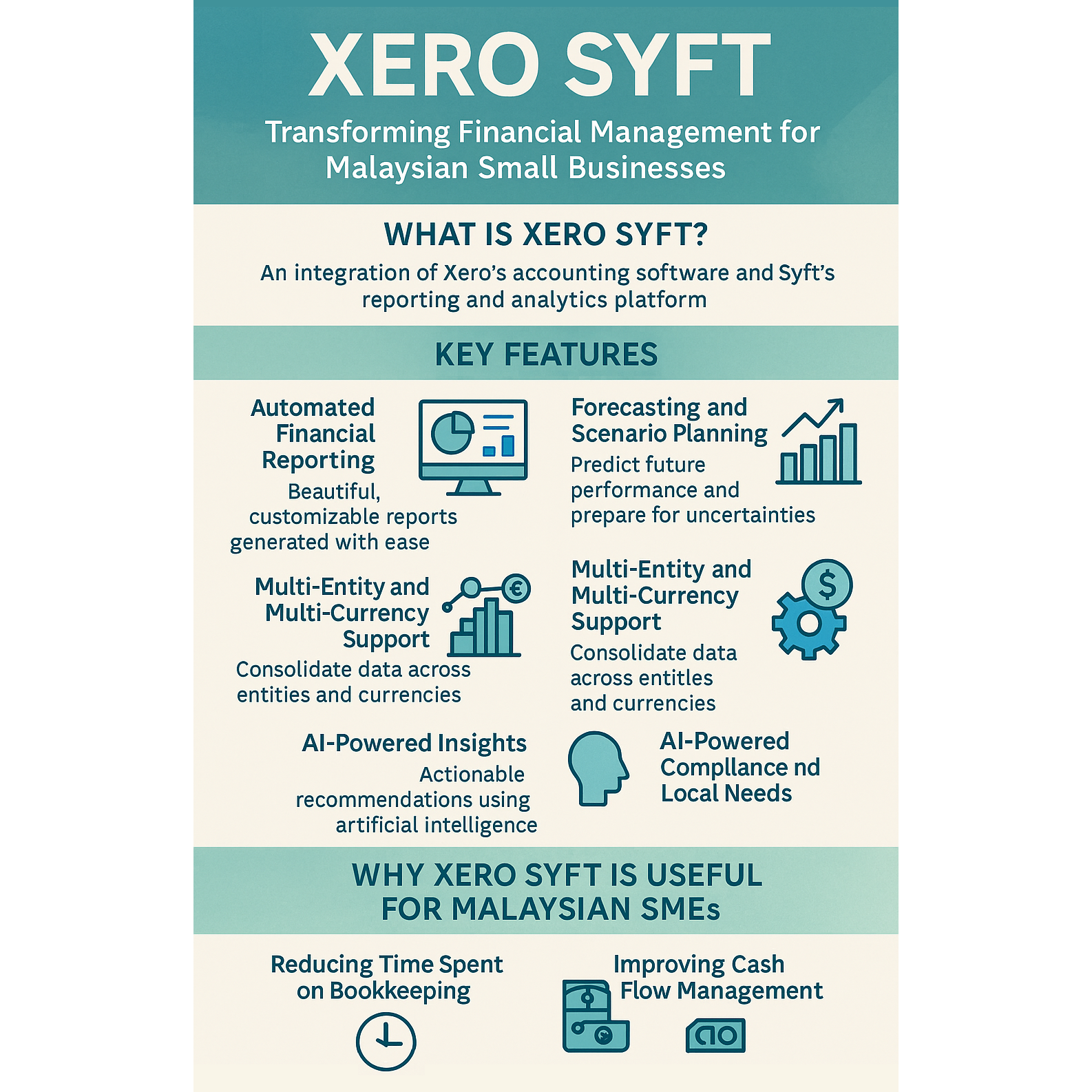

Xero Syft: Transforming Financial Management for Malaysian Small Businesses

In Malaysia’s fast-paced and competitive business landscape, small and medium enterprises (SMEs) face constant pressure to stay financially agile and make data-driven decisions.

Enter Xero Syft—a powerful integration that combines the cloud-based accounting capabilities of Xero with the advanced analytics and reporting features of Syft Analytics.

What Is Xero Syft?

Xero Syft is the result of Xero’s acquisition of Syft Analytics in 2024

Syft is a global cloud-based platform that specializes in financial reporting, forecasting, and data visualization. By integrating Syft directly into Xero’s accounting software, users now have access to real-time, interactive financial insights without needing separate tools or complex spreadsheets.

Key Features of Xero Syft

- Automated Financial Reporting

Generate beautiful, customizable reports with just a few clicks. These reports can be scheduled and shared automatically, saving time and reducing manual work. - Interactive Dashboards

Visualize income, expenses, cash flow, and other key metrics using charts and graphs that update in real time from your Xero data. - Forecasting and Scenario Planning

Predict future performance using Syft’s forecasting tools. Malaysian SMEs can simulate different business scenarios to prepare for uncertainties. - Benchmarking and KPI Tracking

Compare your business performance against industry peers and set custom KPIs to monitor progress. - Multi-Entity and Multi-Currency Support

For businesses operating across regions or managing multiple entities, Syft consolidates data seamlessly, even across different currencies. - AI-Powered Insights

Syft uses artificial intelligence to generate summaries and suggestions, helping business owners make smarter decisions faster

Built-In Analytics at No Extra Cost

One of the standout advantages of using Xero is that its business plans come with a base level of analytics included at no additional cost.

This includes:

- Short-term cash flow: A basic tool to project cash flow up to 30 days into the future.

- Business snapshot: A dashboard that gives you a high-level overview of key financial metrics, like income and expenses.

This means even small businesses operating on tighter budgets can access essential financial insights without needing to invest in separate tools. Users can view performance dashboards, track key financial metrics, and generate basic reports directly within Xero.

For Malaysian SMEs, this built-in functionality offers a cost-effective way to stay on top of cash flow, monitor expenses, and make informed decisions—right from the start.

How Xero Syft Can Be a Game-Changer for Malaysian SMEs

Malaysian SMEs often struggle with limited resources, manual accounting processes, and lack of real-time financial visibility.

Xero Syft addresses these challenges by:

- Reducing Time Spent on Bookkeeping

Automation frees up business owners to focus on growth rather than paperwork. - Improving Cash Flow Management

Real-time bank feeds and forecasting tools help track and manage cash flow effectively. - Enhancing Decision-Making

With clear visuals and AI-generated insights, business owners can make informed decisions quickly. - Supporting Compliance and Local Needs

Xero supports Malaysian tax regulations, local banks, and currency, making it highly relevant for local businesses.

More on Xero

- Expense Management Made Simple with Xero

- Why Xero Works for Small Businesses in Malaysia

- Xero Business Snapshot: Your Financial Dashboard

- Xero Security: Protecting Your Financial Data

- Xero’s Watchlist feature

- Xero and LHDN E-Invoicing: Preparing for Malaysia’s Phase 4 in 2026

- Xerocon Brisbane 2025: How Xero’s AI, Analytics, and Smarter Tools are Supercharging Small Businesses