This post is also available in:

Bahasa Malaysia

Running a small business means constantly balancing short-term performance with long-term growth. To stay financially healthy, it’s essential to track key indicators that reveal how well your business is doing — and how it can improve.

In this guide, we’ll explore four powerful metrics:

- Gross Profit Margin

- Net Profit Margin

- Return on Assets (ROA)

- Return on Equity (ROE)

Each one offers unique insights into your business’s profitability and sustainability — and we’ll also share practical tips to improve them.

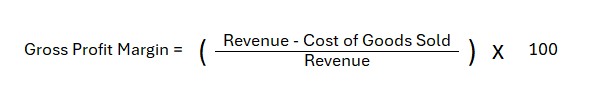

1. Gross Profit Margin

Gross Profit Margin measures how efficiently your business produces and sells goods or services.

Formula:

Why It Matters:

- Reveals core profitability

- Helps with pricing and cost control

- Indicates operational efficiency

Tips to Improve:

- Negotiate better supplier rates

- Reduce waste and improve inventory management

- Streamline production processes

- Focus on high-margin products or services

- Review pricing strategy to reflect value

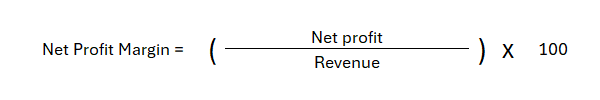

2. Net Profit Margin

Net Profit Margin shows how much of your revenue remains as actual profit after all expenses.

Formula:

Why It Matters:

- Reflects overall profitability

- Helps assess financial viability

- Useful for comparing performance over time

Tips to Improve:

- Cut unnecessary operating expenses

- Automate repetitive tasks to reduce labor costs

- Improve marketing ROI to attract higher-value customers

- Monitor and manage debt and interest payments

- Use tax incentives and deductions wisely

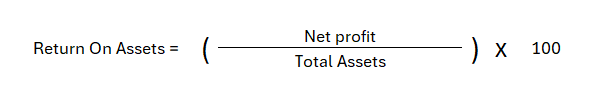

3. Return on Assets (ROA)

ROA measures how effectively your business uses its assets to generate profit.

Formula:

Why It Matters:

- Indicates asset efficiency

- Helps evaluate investment decisions

- Useful for comparing across industries

Tips to Improve:

- Sell or repurpose underutilized assets

- Invest in technology that boosts productivity

- Lease instead of buy when appropriate

- Focus on asset-light business models

- Increase revenue without proportionally increasing assets

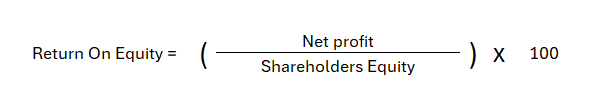

4. Return on Equity (ROE)

ROE shows how well your business is generating returns for its owners or shareholders.

Formula:

Why It Matters:

- Measures profitability relative to owner investment

- Helps assess financial leverage

- Important for attracting investors or lenders

Tips to Improve:

- Increase net profit through better cost control and pricing

- Avoid excessive equity dilution

- Use debt strategically to leverage growth (with caution)

- Retain earnings to reinvest in high-return projects

- Improve operational efficiency to boost profits

Final Thoughts

Tracking and improving these four metrics can transform how you manage your business:

|

Metric |

Focus Area |

Improvement Strategy |

|---|---|---|

|

Gross Profit Margin |

Core operations |

Reduce Cost of goods sold, optimize pricing |

|

Net Profit Margin |

Overall profitability |

Cut expenses, improve efficiency |

|

Return on Assets (ROA) |

Asset efficiency |

Maximize asset use, increase revenue |

|

Return on Equity (ROE) |

Owner returns |

Boost profits, manage equity and leverage wisely |