This post is also available in:

Bahasa Malaysia

Understanding the Numbers That Drive Your Business

For small business owners, staying on top of your financial health is essential—not just for compliance, but for making informed decisions that support growth and stability.

This collection of articles is designed to demystify the key accounting reports every business owner should monitor.

Whether you’re managing cash flow, tracking profitability, or planning for expansion, these reports offer valuable insights into your business’s performance.

In clear, practical terms, we’ll walk you through what each report means, why it matters, and how to use it to make smarter business decisions.

Do Small Business Owners Still Need to Understand Accounting?

Today, user-friendly accounting systems like Xero, QuickBooks Online, and Bukku allow business owners to run operations, stay compliant, and track performance—all without needing to become accountants.

Understanding Income Statements and Balance Sheets: Why They Are Crucial for Your Business

Financial statements are critical tools used by businesses to provide a comprehensive overview of their financial health. These essential documents include a variety of detailed reports, but the income statement and the balance sheet are among the most commonly used.

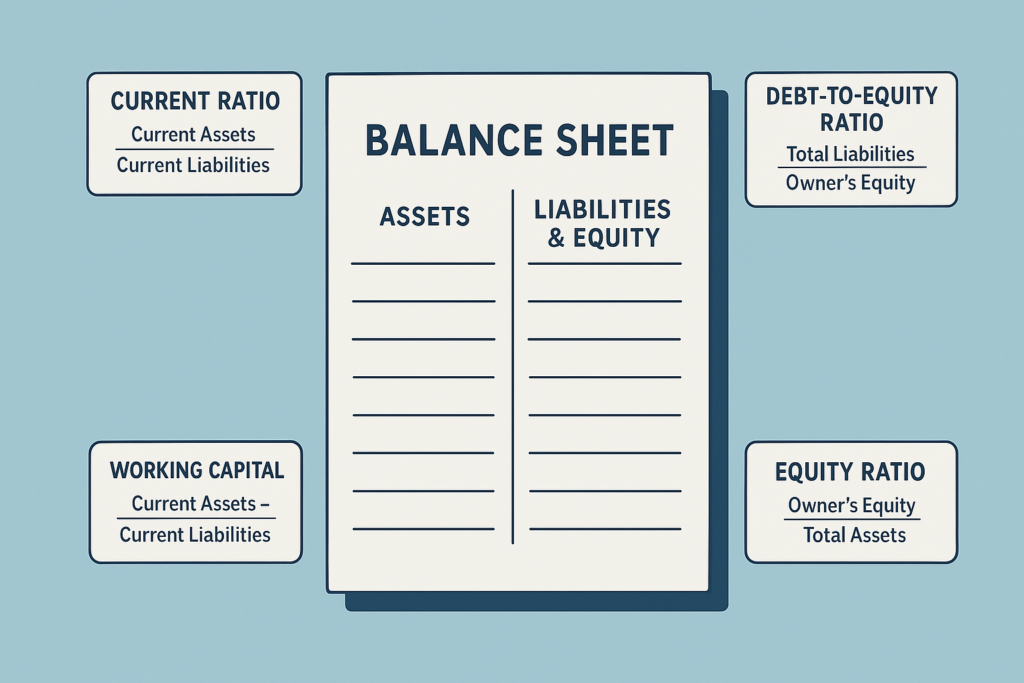

What is a Balance Sheet?

A Balance Sheet is a financial statement that shows your business’s financial position at a specific point in time. Think of it like a snapshot of what your business owns, owes, and how much is left for you (the owner).

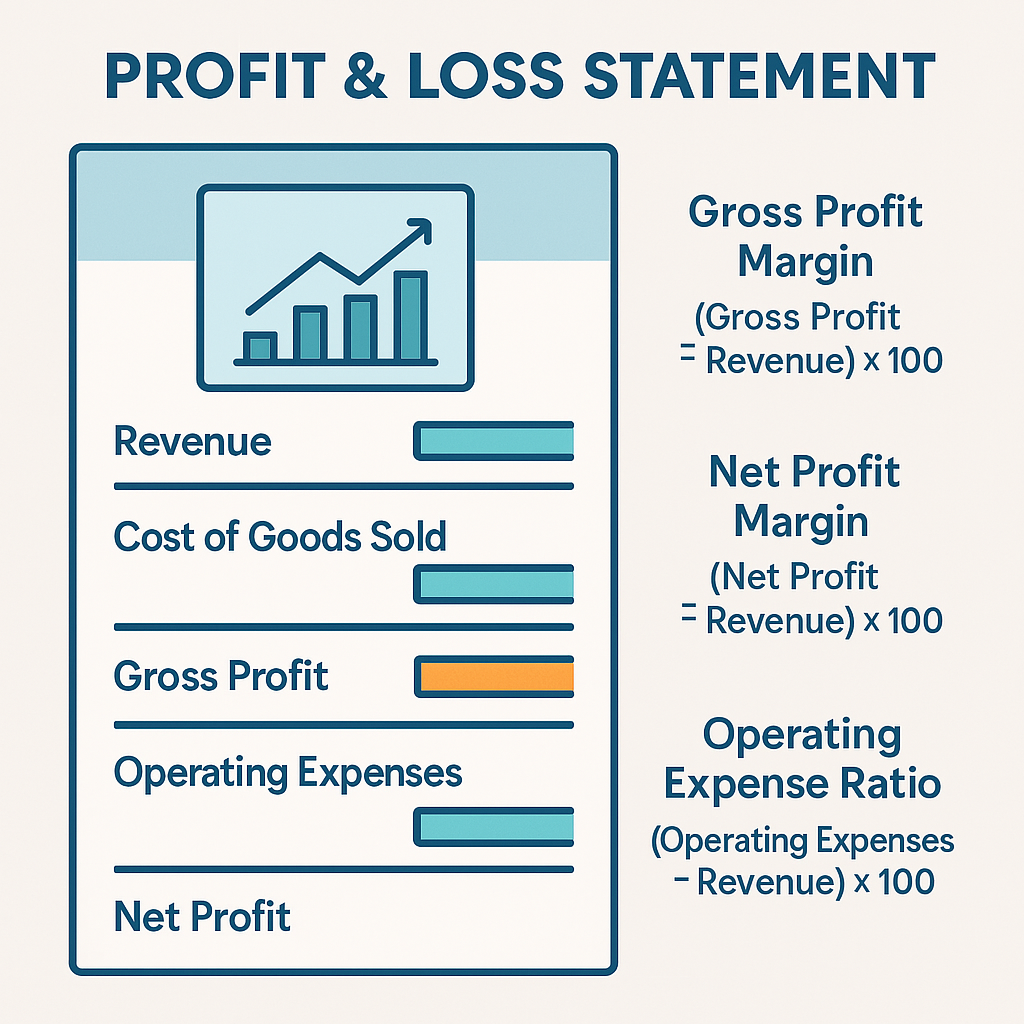

What is a Profit and Loss (P&L) Statement?

Also known as an Income Statement, the Profit & Loss Statement is a financial report that shows your business’s revenue, expenses, and profit or loss over a specific period — usually monthly, quarterly, or yearly.

The Importance of AI in Accounting for Small Businesses

Small businesses often face financial constraints, limited manpower, and the need for efficient financial management.

AI-driven accounting solutions help streamline operations, reduce costs, and provide valuable insights, allowing small business owners to focus on growth.