This post is also available in:

Bahasa Malaysia

Running a small business in Malaysia isn’t easy. You wear many hats—from sales to operations to finance. And when it comes to financial health, one common mistake many SME owners make is confusing profit with cash flow. The two might sound similar, but they mean very different things—and misunderstanding them can spell trouble.

Let’s break it down in simple terms.

What is Profit?

Profit is what’s left after you deduct all your expenses from your revenue. It’s what you see on your Profit & Loss Statement (P&L), and it comes in a few forms:

- Gross Profit = Revenue – Cost of Goods Sold (COGS)

- Operating Profit = Gross Profit – Operating Expenses

- Net Profit = Operating Profit – Taxes and Other Expenses

Profit tells you whether your business is making money on paper.

What is Cash Flow?

Cash flow refers to the actual movement of cash in and out of your business. It’s tracked in your Cash Flow Statement and shows whether you have enough cash to pay your bills, salaries, and suppliers.

There are three types of cash flow:

- Operating Cash Flow – From your core business operations

- Investing Cash Flow – From buying/selling assets

- Financing Cash Flow – From loans or capital injection

A business can be profitable but still run out of cash—and that’s a dangerous place to be.

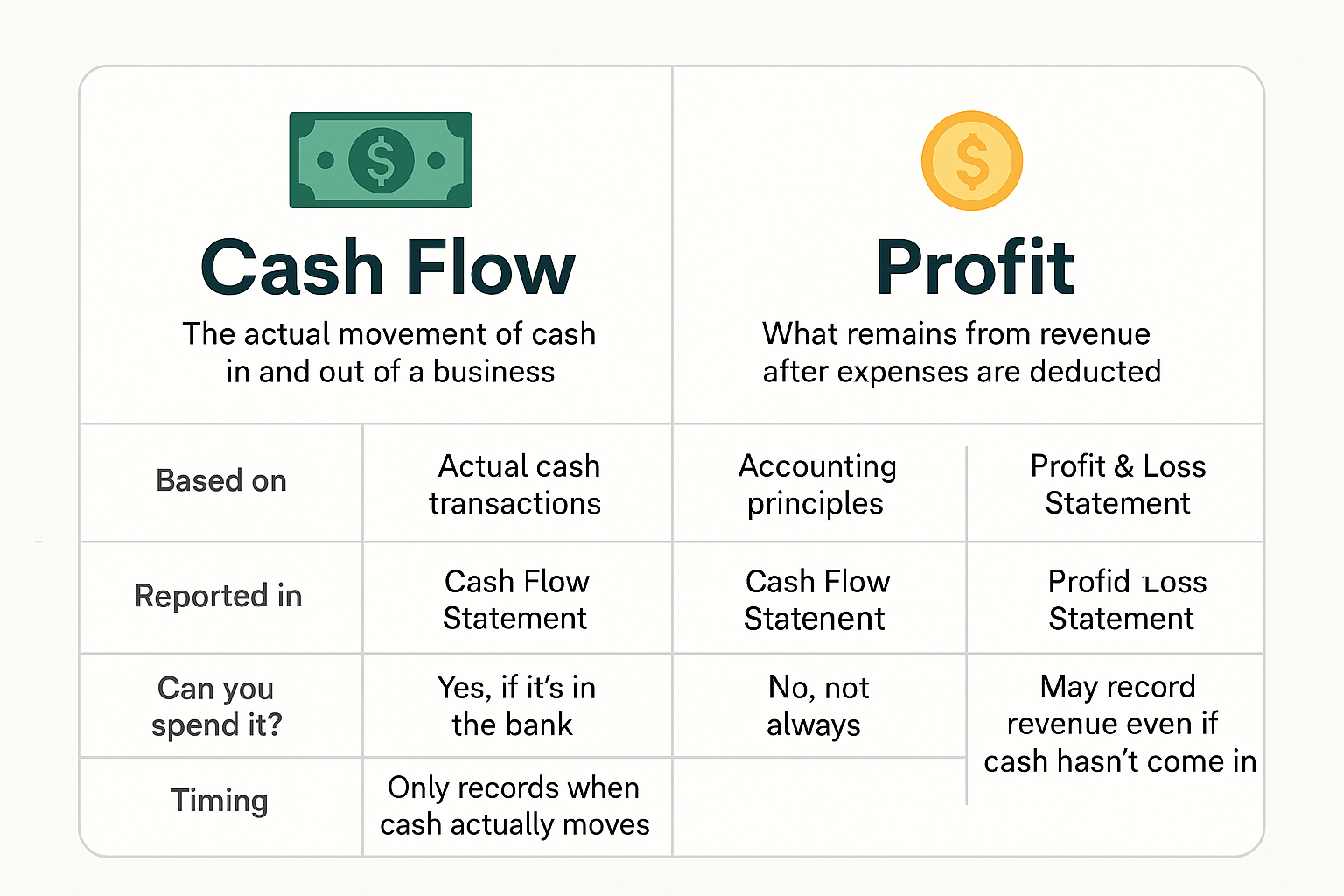

Profit vs Cash Flow: What’s the Difference?

|

Aspect |

Profit |

Cash Flow |

|---|---|---|

|

Based on |

Accounting principles (e.g., accrual) |

Actual cash transactions |

|

Reported in |

Profit & Loss Statement |

Cash Flow Statement |

|

Can you spend it? |

No – not always |

Yes – if it’s in the bank |

|

Timing |

May record revenue even if cash hasn’t come in |

Only records when cash actually moves |

Why Malaysian SMEs Should Care

In Malaysia, many SMEs struggle with late payments and tight margins. Even if your accounts show a healthy profit, delayed collections or poor cash flow planning can leave you unable to meet obligations.

Here are real-world situations where cash flow matters more than profit:

- You made a big sale, but the customer pays 90 days later—how do you cover costs meanwhile?

- You invested in equipment using cash, but the expense won’t appear in your P&L all at once.

- You’re profitable on paper, but can’t pay staff salaries this month.

How to Stay on Top of Both

- Monitor Cash Flow Regularly

Don’t just rely on your profit reports. Review your cash flow weekly or monthly. - Use Cloud Accounting Tools

Solutions like Bukku, Xero and QuickBooks Online make it easier to see real-time financials. - Plan for Seasonality

Forecast your low and high months so you can plan cash reserves. - Speed Up Collections

Offer early payment discounts or automate reminders for invoices. (See The importance of monitoring accounts receivables) - Work with a Consultant

If numbers aren’t your thing, partner with an outsourced accounting service (like Adventus) to guide you.

In summary

Profit tells you whether your business model works. Cash flow tells you whether you can survive and grow. To succeed as a Malaysian SME, you need to manage both.

Don’t let your business become another statistic. Stay informed, stay in control—and if you’re unsure, seek help before it’s too late.

Need help understanding your business numbers?

At Adventus, we help Malaysian SMEs like yours manage cash flow, plan ahead, and grow confidently. Get in touch with us for a free initial consultation.

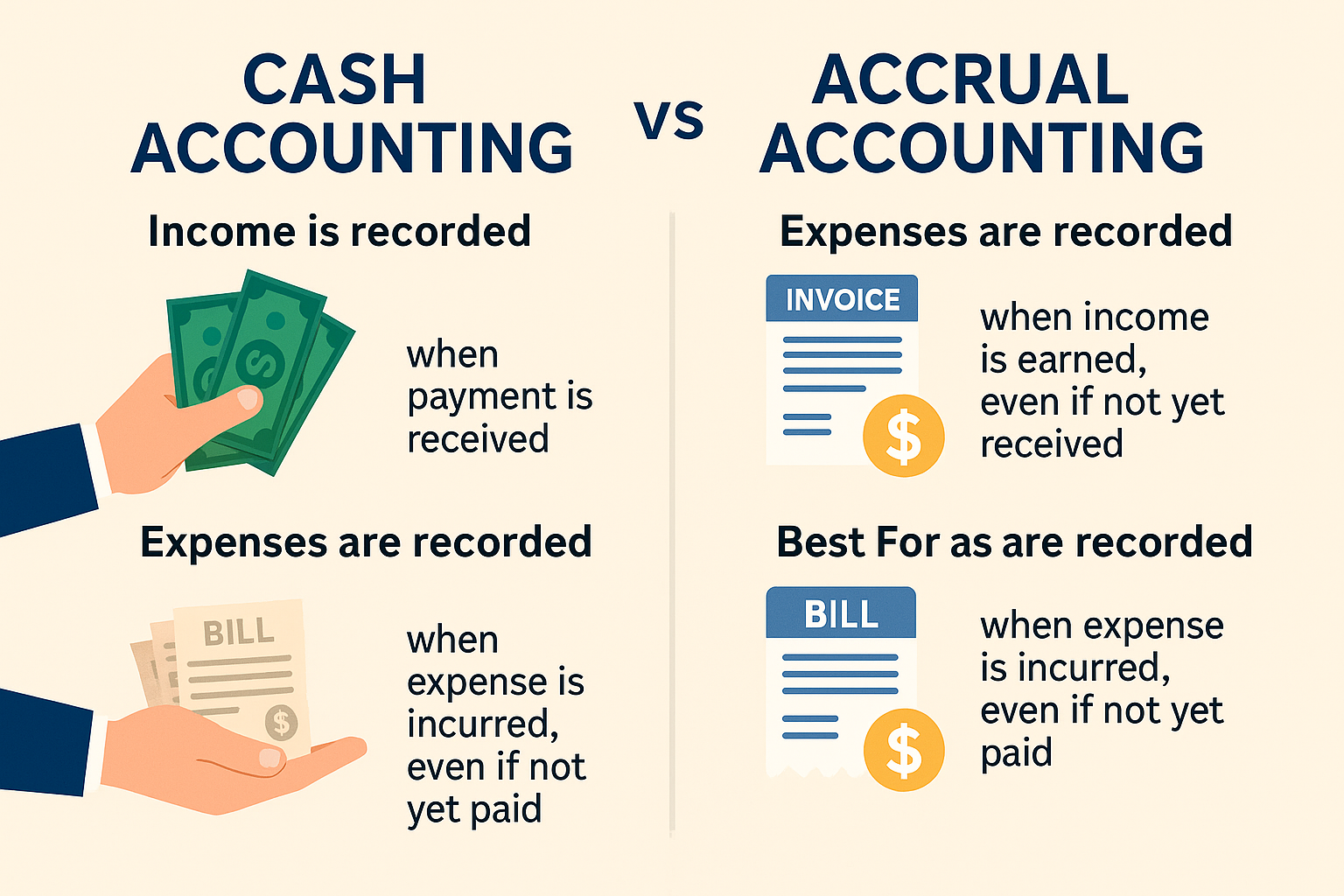

Accrual vs Cash Accounting: What Every Small Business Owner Should Know

You’ve probably come across the terms accrual accounting and cash accounting. These are two different ways to track your income and expenses — and choosing the right one can make a big difference in how well you understand your business finances.