This post is also available in:

Bahasa Malaysia

Running a small business comes with inherent risks, from financial setbacks to operational inefficiencies.

The Swiss Cheese Theory, developed by British psychologist James Reason, provides a valuable framework for understanding how small businesses can mitigate risks and prevent failures.

By applying this theory, small business owners can establish multiple layers of protection to safeguard their operations.

What is the Swiss Cheese Theory?

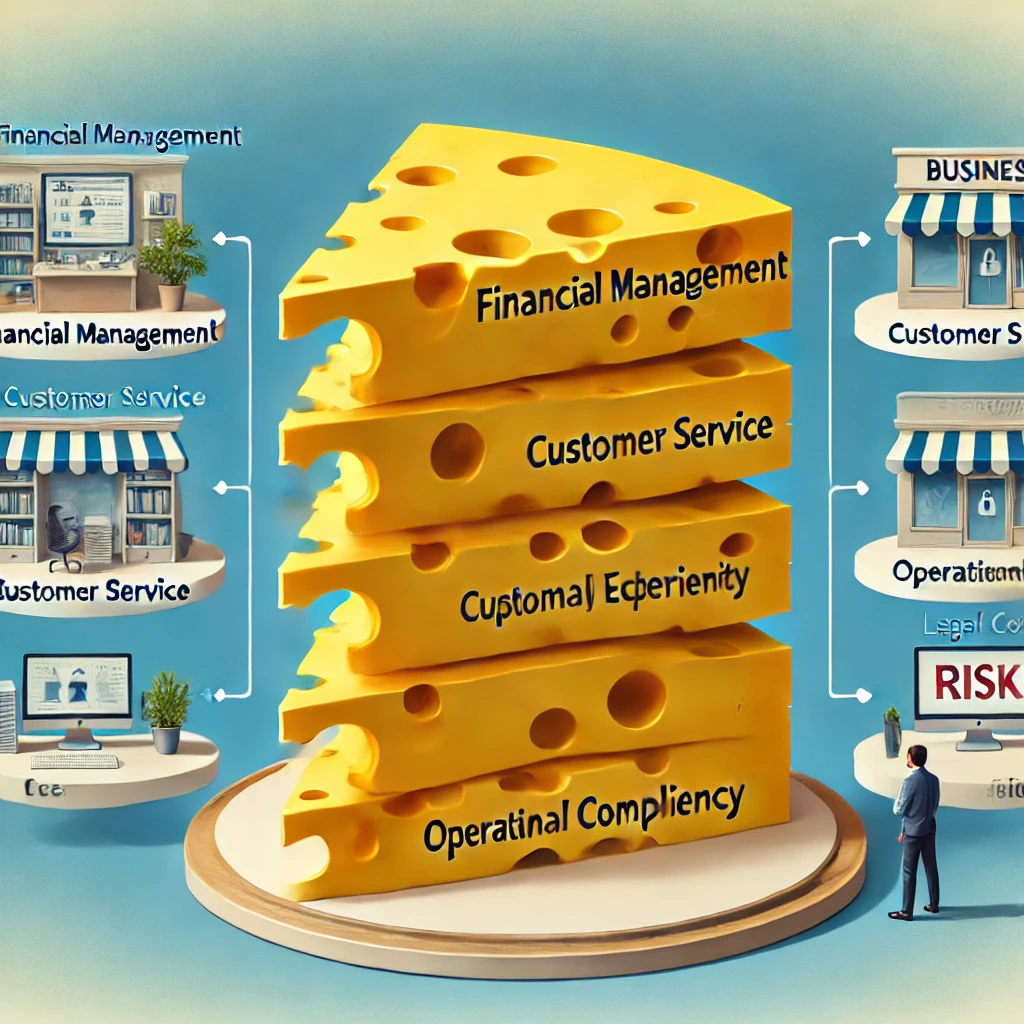

The Swiss Cheese Theory visualizes a business’s risk management system as slices of Swiss cheese, where each slice represents a different layer of defense. However, like real Swiss cheese, these layers have holes—weaknesses or gaps in the system. When the holes in multiple layers align, a failure or business setback can occur.

The key to mitigating risks is ensuring that these layers overlap and compensate for each other’s weaknesses, reducing the likelihood that all the gaps align at the same time.

How Small Businesses Can Apply the Swiss Cheese Theory

1. Financial Management

Small businesses must have multiple safeguards in place to prevent financial crises. Strategies include setting aside emergency funds, maintaining accurate financial records, and regularly reviewing cash flow projections. If one layer (e.g., delayed payments from clients) fails, other financial safeguards can help prevent a major financial crisis.

2. Customer Service and Reputation Management

A small business’s reputation is crucial for success. Layers of defense in customer service include proper staff training, prompt response to customer complaints, and active reputation management on social media and review platforms. If a single customer service mistake occurs, a strong recovery strategy can prevent long-term damage.

3. Cybersecurity and Data Protection

Cyber threats are a growing risk for small businesses. Implementing multiple layers of protection—such as secure passwords, regular software updates, employee cybersecurity training, and backup systems—can prevent data breaches. Even if one layer fails, others can prevent a major security incident.

4. Operational Efficiency and Business Continuity

Inefficiencies and disruptions can slow down business operations. Small businesses can apply the Swiss Cheese Theory by implementing clear processes, cross-training employees, and using automated systems. This ensures that if one process fails, others can maintain business continuity.

Operational debt refers to the inefficiencies, shortcuts, or neglected tasks that accumulate over time in a business, much like financial debt.

It typically arises from delayed maintenance, outdated processes, untrained staff, or neglected system upgrades.

5. Legal and Compliance Risks

Regulatory compliance is a critical aspect of running a small business. Multiple layers of defense, such as consulting legal experts, maintaining proper documentation, and regularly reviewing policies, can protect against costly legal issues.

Strengthening the Layers to Minimize Risks

To effectively reduce risks, small businesses should:

- Identify Vulnerabilities: Regularly assess potential risks in different areas of the business.

- Implement Multiple Safeguards: Introduce layered solutions to cover weaknesses.

- Monitor and Adapt: Continuously improve risk management strategies.

- Foster a Risk-Aware Culture: Encourage employees to proactively identify and report risks.

Conclusion

The Swiss Cheese Theory emphasizes that while no business is immune to risk, implementing multiple layers of defense significantly reduces potential failures. By applying this model to financial management, customer service, cybersecurity, operations, and legal compliance, small business owners can proactively safeguard their businesses, ensuring long-term success and resilience.