This post is also available in:

Bahasa Malaysia

Running a successful business requires more than just hard work and dedication—it demands a clear understanding of your financial and operational performance.

Key metrics, often referred to as Key Performance Indicators (KPIs), provide critical insights into your business’s health and help you make informed decisions.

Here are the essential metrics every business should watch closely:

1. Revenue Metrics

- Total Revenue: Tracks the total income generated from sales. Monitoring revenue trends helps assess the overall growth of your business.

- Revenue Growth Rate: Measures the percentage increase or decrease in revenue over a specific period. A steady growth rate indicates a thriving business.

- Recurring Revenue: For subscription-based models, tracking Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR) provides insights into predictable income streams.

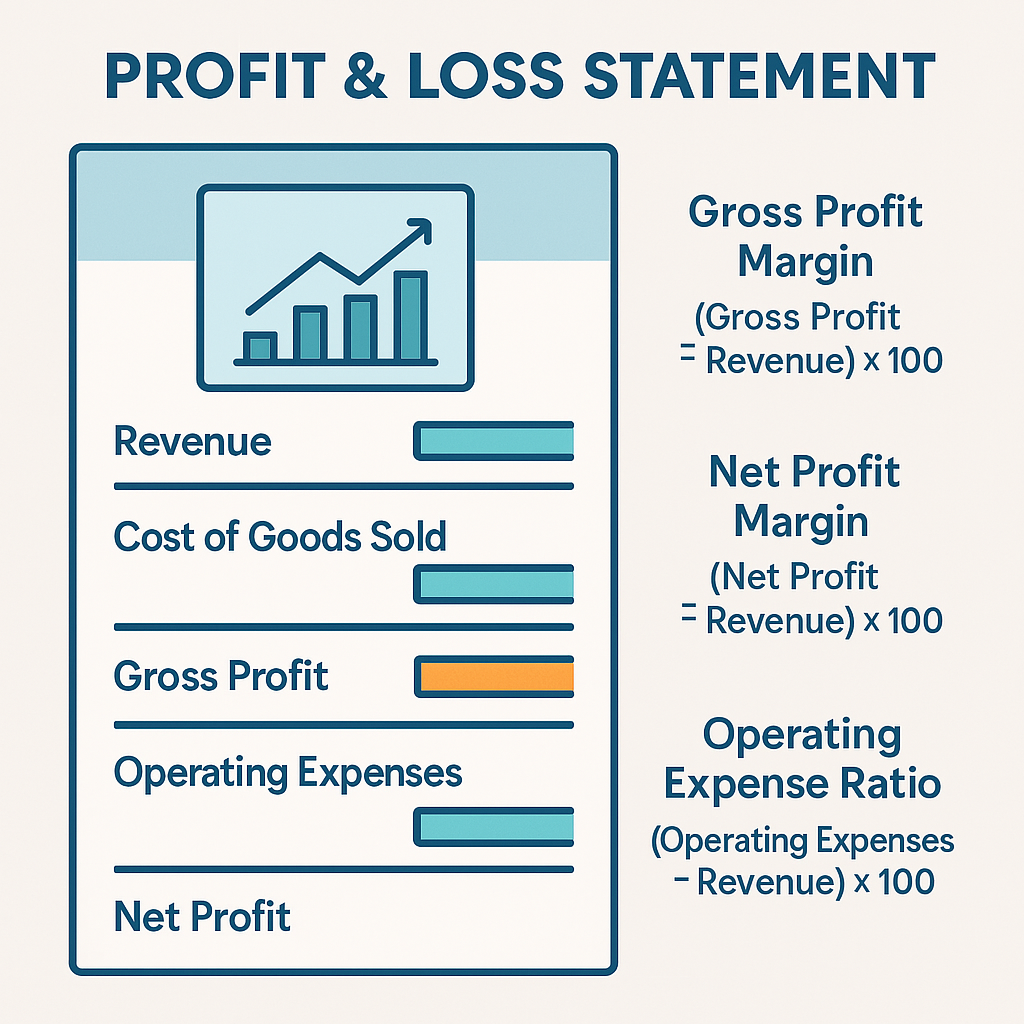

2. Profitability Metrics

- Gross Profit Margin: The percentage of revenue remaining after deducting the cost of goods sold (COGS). It reveals how efficiently you produce or sell products.

- Net Profit Margin: The percentage of revenue left after all expenses, including taxes and interest, are deducted. This is a clear indicator of your business’s overall profitability.

- Break-Even Point: The revenue level at which total expenses equal total income. Understanding this point helps determine how much you need to sell to avoid losses.

3. Cash Flow Metrics

- Operating Cash Flow: Measures the cash generated from regular business operations. Positive cash flow indicates the business can cover its expenses.

- Cash Burn Rate: For startups and growing businesses, this metric tracks how quickly cash reserves are being used. It’s crucial for understanding runway and sustainability.

- Accounts Receivable Turnover: Evaluates how quickly you collect payments from customers, which impacts cash flow.

4. Customer Metrics

- Customer Acquisition Cost (CAC): The cost of acquiring a new customer. Lower CAC indicates efficient marketing and sales strategies.

- Customer Lifetime Value (CLV): The total revenue a business expects from a single customer throughout their relationship. A higher CLV relative to CAC is a sign of profitability.

- Customer Retention Rate: Tracks the percentage of customers who continue to do business with you over time. High retention rates indicate customer satisfaction and loyalty.

5. Operational Metrics

- Inventory Turnover: Measures how often inventory is sold and replaced over a period. Efficient inventory management reduces storage costs and waste.

- Employee Productivity: Tracks output per employee, helping assess workforce efficiency and identify areas for improvement.

- Average Order Value (AOV): The average revenue per order. Increasing AOV can boost overall revenue without acquiring new customers.

6. Marketing Metrics

- Conversion Rate: The percentage of leads or website visitors that turn into paying customers. Improving conversion rates can significantly impact revenue.

- Return on Investment (ROI): Evaluates the profitability of marketing campaigns. It ensures marketing spend is yielding positive returns.

- Website Traffic and Engagement: Monitoring website metrics like unique visitors, bounce rate, and time spent on site provides insights into your online presence’s effectiveness.

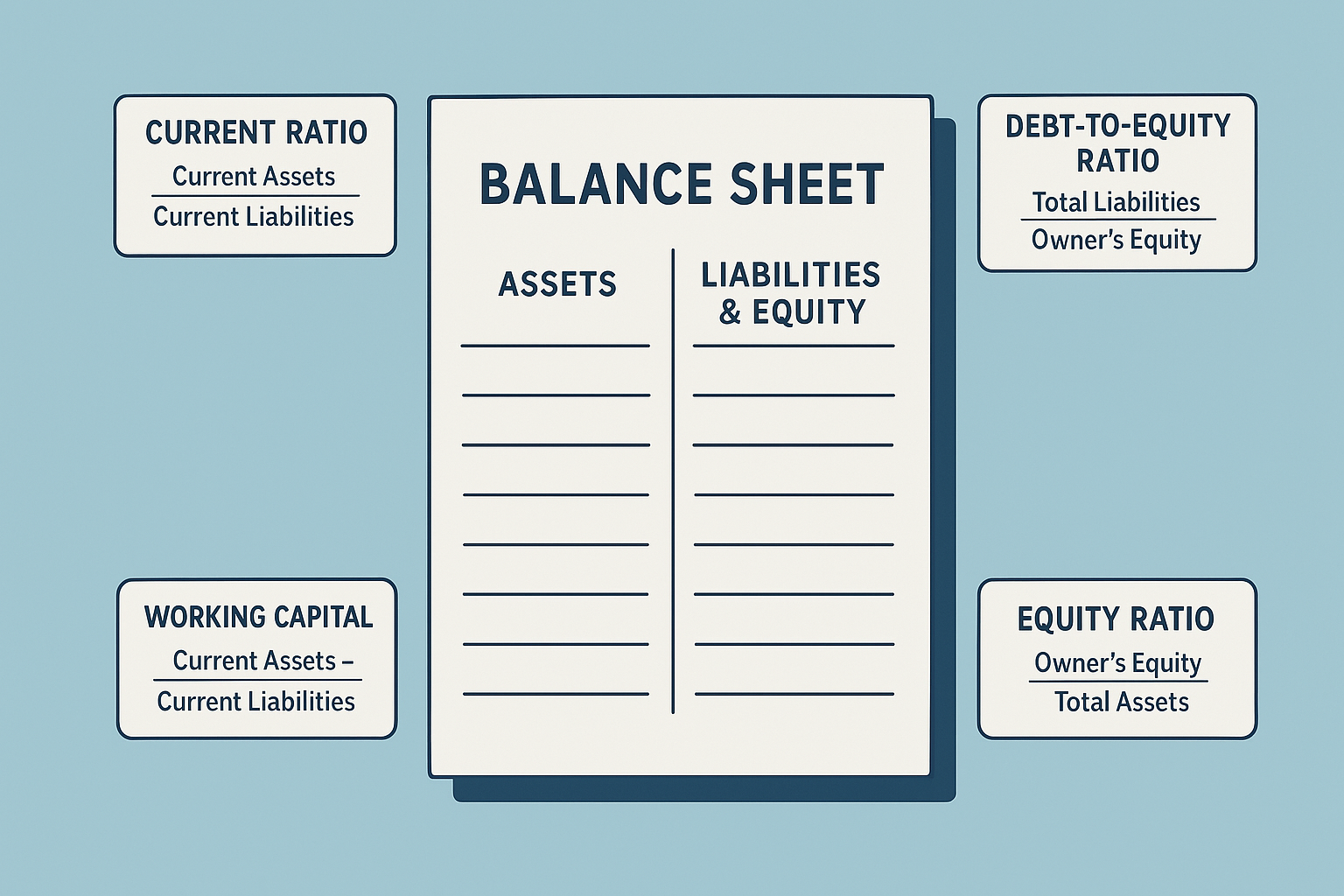

7. Financial Health Metrics

- Debt-to-Equity Ratio: Compares total debt to shareholders’ equity. A lower ratio indicates a healthier balance between debt and equity financing.

- Current Ratio: Measures liquidity by comparing current assets to current liabilities. A ratio above 1 indicates the ability to meet short-term obligations.

- Return on Equity (ROE): Assesses how effectively a business uses shareholders’ equity to generate profit.

8. Industry-Specific Metrics

- Depending on your industry, specific metrics like churn rate (for SaaS businesses), average table turnover (for restaurants), or utilization rate (for service providers) may be critical to track.

Why Monitoring Metrics Matters

Tracking key metrics ensures you stay informed about your business’s performance, enabling you to identify strengths, address weaknesses, and seize growth opportunities.

Regularly reviewing these metrics helps align your strategy with your goals, making it easier to adapt to market changes and achieve long-term success.

Final Thoughts

No matter the size or type of your business, monitoring the right metrics is essential for making informed decisions and driving success.

By focusing on these key indicators, you can gain a clear understanding of your business’s health, stay ahead of potential challenges, and create a roadmap for sustained growth.

Remember, what gets measured gets managed.

What is a Balance Sheet?

A Balance Sheet is a financial statement that shows your business’s financial position at a specific point in time. Think of it like a snapshot of what your business owns, owes, and how much is left for you (the owner).

What is a Profit and Loss (P&L) Statement?

The Profit & Loss Statement is a financial report that shows your business’s revenue, expenses, and profit or loss over a specific period — usually monthly, quarterly, or yearly.