This post is also available in:

Bahasa Malaysia

Navigating Payroll Processing for Small Businesses in Malaysia

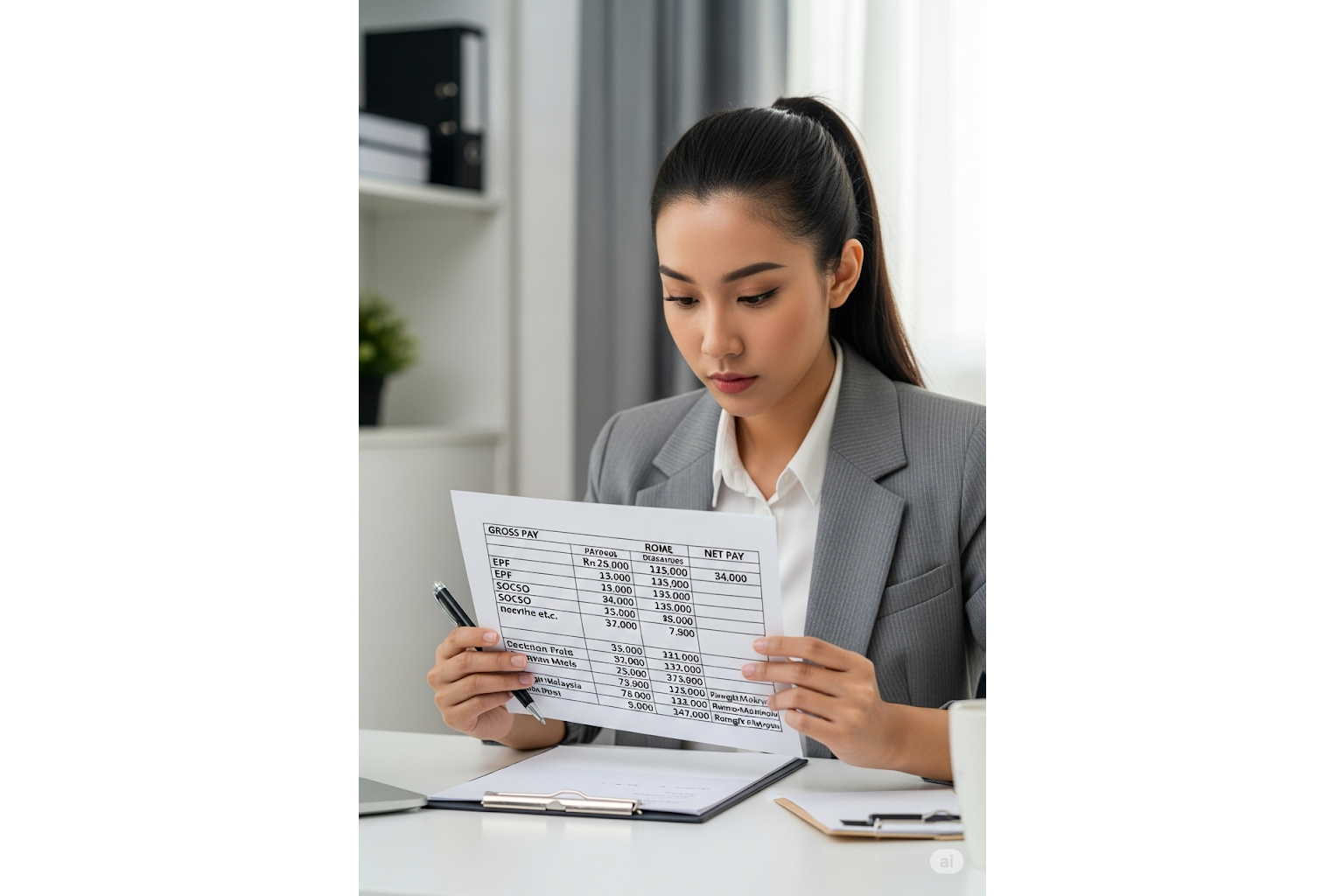

Managing payroll is one of the most critical — and often challenging — responsibilities for small business owners in Malaysia. From complying with statutory requirements like EPF, SOCSO, EIS, and PCB, to handling leave, overtime, and payslip generation, payroll processing involves more than just paying salaries. It requires accuracy, timeliness, and a sound understanding of ever-evolving local regulations.

This collection of articles and tips is designed specifically for small business owners and payroll administrators in Malaysia. Whether you’re handling payroll in-house or using outsourced services, you’ll find practical guidance to help streamline your processes, avoid common pitfalls, and stay compliant with Malaysian labour and tax laws.

Understanding Malaysian Payroll

Whether you’re a small business owner, HR executive, or payroll officer, understanding the components that go into salary calculation—and complying with statutory requirements—is crucial.

This guide breaks down everything you need to know about Malaysian payroll, including basic pay, allowances, overtime, bonuses, deductions, and statutory contributions like EPF, SOCSO, and PCB.

Overtime Entitlement under Malaysia’s Employment Act 1955

Overtime refers to any work performed beyond the normal working hours as defined in the Employment Act.

Learn who is entitled to overtime pay in Malaysia, applicable rates, definitions, and key exceptions under the Employment Act 1955 (updated for 2023).

Understanding PCB

In Malaysia, Potongan Cukai Bulanan (PCB) or Monthly Tax Deduction is a system where employers deduct monthly income tax from their employees’ salaries and remit it to LHDN (Inland Revenue Board of Malaysia).

LHDN provides a complex formula for the calculation of Potongan Cukai Bulanan (PCB), also known as Monthly Tax Deduction (MTD). Learn more about it.

Understanding Benefits in Kind

When calculating Potongan Cukai Bulanan (PCB) for employees in Malaysia, employers must consider not only salaries and bonuses but also Benefits in Kind (BIK) — non-cash benefits provided to employees as part of their employment package. These are subject to income tax unless exempted, and must be included in monthly PCB computations.