This post is also available in:

Bahasa Malaysia

In Malaysia, Potongan Cukai Bulanan (PCB) or Monthly Tax Deduction is a system where employers deduct monthly income tax from their employees’ salaries and remit it to LHDN (Inland Revenue Board of Malaysia).

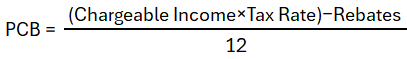

Overview of the Formula

PCB is generally calculated as:

But to get to this point, you need to compute Chargeable Income first, which is done in multiple steps.

Step-by-Step Manual Calculation

Step 1: Determine Gross Monthly Income

This includes:

- Basic salary

- Overtime

- Bonus

- Commission

- Allowances (taxable ones)

- Benefits-in-kind

- Perquisites

Exclude non-taxable benefits like travel allowances (up to a limit), EPF employer contributions (up to a limit), or medical benefits.

Step 2: Deduct Approved Monthly Tax Reliefs and Deductions

These include:

| Item | Description | Max Limit (Annual) |

|---|---|---|

| EPF Contribution | Up to RM4,000/year | RM333.33/month |

| SOCSO & EIS | Full amount | Varies |

| Life Insurance (if not claimed under EPF) | RM3,000/year | RM250/month |

| Zakat | Full rebateable | Actual paid |

| Personal Relief | RM9,000/year | RM750/month |

| Spouse Relief | RM4,000/year (if applicable) | RM333.33/month |

| Child Relief | RM2,000–RM6,000/year per child | RM166.67–RM500/month |

| Others | Education fees, medical expenses, etc. | Varies |

Step 3: Compute Chargeable Income

Chargeable Income=Gross Income−Approved Reliefs

Step 4: Apply Tax Rates on Chargeable Income

Malaysia has a progressive income tax rate, for example (as of YA2024):

| Chargeable Income (RM) | Tax Rate (%) |

|---|---|

| 0 – 5,000 | 0% |

| 5,001 – 20,000 | 1% |

| 20,001 – 35,000 | 3% |

| 35,001 – 50,000 | 6% |

| 50,001 – 70,000 | 11% |

| 70,001 – 100,000 | 19% |

| … | … |

You can view the list provided by LHDN here Tax Rate.

The monthly tax is worked out based on how much the employee has earned in total so far this year, with higher earnings taxed at higher rates.

Step 5: Deduct Rebates

- Zakat (if not already deducted in Step 2)

- Tax Rebates (e.g. RM400 for individuals with income under RM35,000)

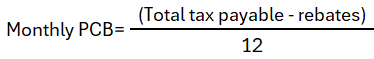

Step 6: Divide Annual Tax by 12

This gives you the monthly PCB amount.

Example Calculation

Assume:

- Monthly gross salary: RM5,000

- EPF (11%): RM550

- SOCSO & EIS: RM50

- No spouse, no children

- No additional deductions

Step 1: Gross Income = RM5,000/month → RM60,000/year

Step 2: Deductions:

- EPF: RM6,600

- SOCSO + EIS: RM600

- Personal Relief: RM9,000

Total Reliefs = RM16,200

Step 3: Chargeable Income = RM60,000 – RM16,200 = RM43,800

Step 4: Tax Computation:

| Chargeable Income | Rate % | Tax |

|---|---|---|

| 0–5,000 | 0% | RM0.00 |

| 5,001–20,000 | 1% | RM150.00 |

| 20,001–35,000 | 3% | RM450.00 |

| 35,001–43,800 | 6% | RM528.00 |

| Total Tax | RM1,128.00 |

Step 5: No rebates

Step 6: Monthly PCB = RM1,128 ÷ 12 = RM94.00

Summary of Key Elements

| Element | Description |

|---|---|

| Gross Income | Total monthly income before deductions |

| Reliefs | Tax reliefs including EPF, SOCSO, personal, spouse, children |

| Chargeable Income | Income subject to tax after reliefs |

| Tax Rate | Based on LHDN’s progressive rates |

| Rebates | Direct deduction from tax (zakat, RM400 rebate, etc.) |

| Monthly PCB | Final monthly deduction after all calculations |

Tools You Can Use

- Payroll Software: Like JustLogin with built-in formulas

- LHDN PCB Calculator: https://calcpcb.hasil.gov.my

This article is intended for general informational purposes only. While every effort has been made to ensure its accuracy, we do not guarantee that the information is free from errors or omissions. Users are encouraged to verify any important details independently and should not rely solely on the information provided.