This post is also available in:

Bahasa Malaysia

Managing payroll in Malaysia can be complex, but it doesn’t have to be.

This guide breaks down everything you need to know about Malaysian payroll, including basic pay, allowances, overtime, bonuses, deductions, and statutory contributions like EPF, SOCSO, and PCB.

1. Earnings (Gross Pay Components)

These are the components that contribute to an employee’s gross salary:

A. Basic Salary

- Fixed monthly wage as per employment contract.

B. Fixed Allowances

(Usually contractual or consistently paid)

- Transport allowance

- Meal allowance

- Housing allowance

- Shift allowance

- Mobile/telephone allowance

- Car allowance

C. Variable Allowances/Reimbursements

- Travel claims

- Outstation or per diem allowance

- Mileage claims (non-taxable if within guidelines)

D. Overtime (OT) Pay

- Normal days: 1.5x hourly rate

- Rest days: 2x hourly rate

- Public holidays: 3x hourly rate

Based on Employment Act requirements for employees earning RM4,000.00 or less per month or manual laborers regardless of salary.

E. Commissions & Incentives

- Sales commissions

- Performance incentives

- KPI bonuses

F. Bonus

- Performance bonus (annual, project-based)

- 13th month pay (if offered)

G. Other Payments

- Gratuities

- Back pay or salary arrears

- Redundancy or termination benefits (when applicable)

2. Deductions (Non-Statutory & Statutory)

A. Non-Statutory Deductions

- Advances or Loans

- Salary advances or company loans (deducted monthly per agreement)

- Unpaid Leave

- Deductions based on daily rate

- Absenteeism / Lateness Penalties

- Based on company policy

- Staff purchases or damages

- If agreed in writing and allowed under law

B. Statutory Deductions

These are mandatory under Malaysian law:

| Type | Employee Contribution | Employer Contribution | Remarks |

|---|---|---|---|

| EPF (KWSP) | 11% (standard) | 12%-13% | Subject to wage ceilings |

| SOCSO (PERKESO) | 0.5%-1.25% | 1.75% | For disability & employment injury |

| EIS (SIP) | 0.2% | 0.2% | For retrenchment insurance |

| PCB / MTD (Income Tax) | Based on LHDN schedule | N/A | Monthly tax deduction (Potongan Cukai Berjadual) |

| HRDF (if applicable) | N/A | 1% | Mandatory for companies with ≥10 employees (training levy) |

Note: The exact EPF, SOCSO, and EIS rates vary based on employee age and wages. Use official tables for calculation.

3. Net Salary (Take-home Pay)

Formula:

Net Salary = Gross Salary - (Statutory Deductions + Non-Statutory Deductions)

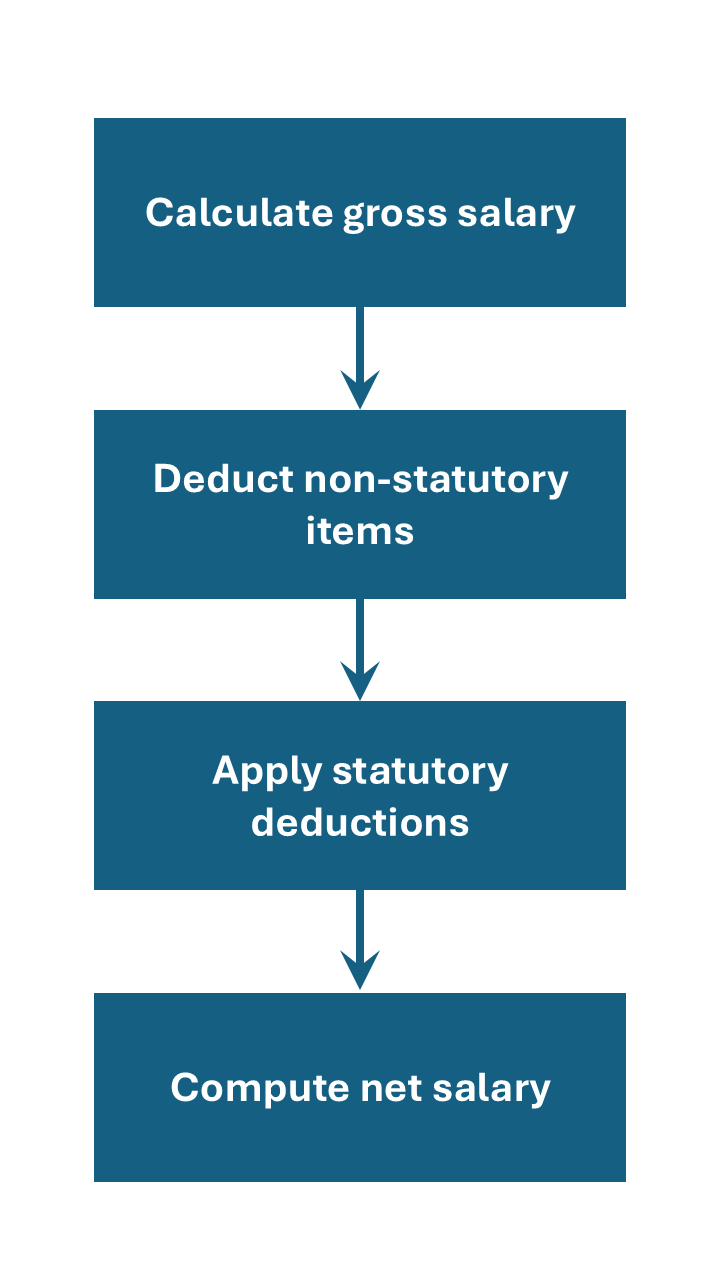

Summary of Payroll Process

|

Step |

Description |

|---|---|

|

1 |

Calculate gross salary (basic + allowances + OT + bonus, etc.) |

|

2 |

Deduct non-statutory items (advances, unpaid leave) |

|

3 |

Apply statutory deductions (EPF, SOCSO, EIS, PCB) |

|

4 |

Compute net salary |