This post is also available in:

Bahasa Malaysia

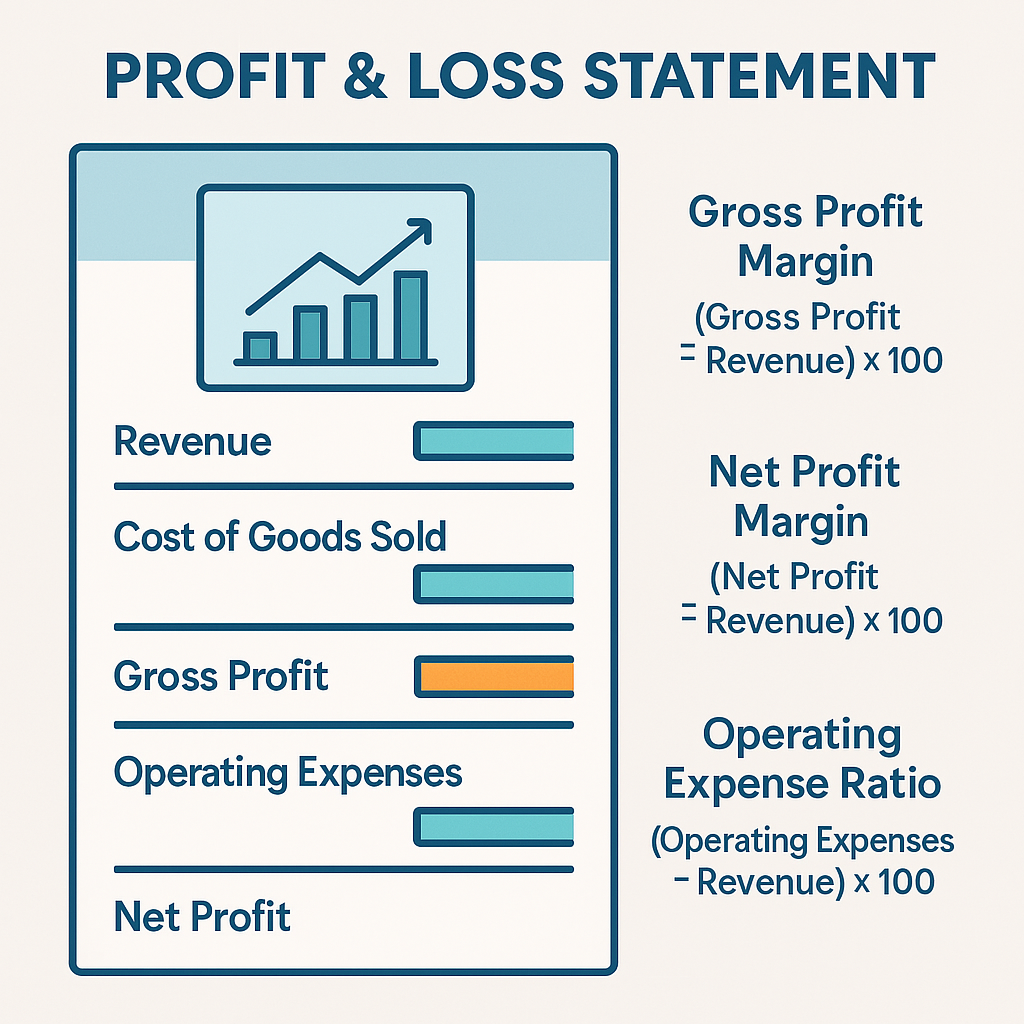

Also known as an Income Statement, the Profit & Loss Statement is a financial report that shows your business’s revenue, expenses, and profit or loss over a specific period — usually monthly, quarterly, or yearly.

Think of it as your business’s “report card” that tells you:

- Whether you’re making a profit or loss

- How much you’re earning (sales/income)

- What you’re spending (costs and expenses)

Key Components of a Profit & Loss Statement

- Revenue/Sales – Total money earned from selling your products or services.

- Cost of Goods Sold (COGS) – Direct costs to produce your goods (e.g. materials, direct labor).

- Gross Profit = Revenue – COGS

- Operating Expenses – Rent, salaries, utilities, marketing, etc.

- Net Profit (or Loss) = Gross Profit – Operating Expenses – Other costs (like taxes, interest)

Useful Ratios for Small Business Owners

These ratios help you interpret the profit & loss statement, so you don’t just see numbers but understand what they mean.

1. Gross Profit Margin

Formula:

(Gross Profit ÷ Revenue) × 100Purpose:

Shows how efficiently you’re producing and selling your goods/services.

High margin = you’re making good money after covering direct costs.

Helpful for:

Comparing different products/services or pricing strategies.

Net Profit Margin

Formula:

(Net Profit ÷ Revenue) × 100Purpose:

Tells you how much of your sales actually turns into profit after all expenses.

Helpful for:

Understanding if your business is financially healthy overall. If this is low, check for high overheads or hidden costs.

3. Operating Expense Ratio

Formula:

(Operating Expenses ÷ Revenue) × 100Purpose:

Shows how much of your income goes into keeping the business running.

Helpful for:

Controlling overhead costs — if too high, time to trim fat.

4. Break-even Point (BEP)

Not a ratio, but a critical figure.

Formula:

Fixed Costs ÷ (Selling Price per Unit – Variable Cost per Unit)Purpose:

Tells you how much you need to sell before making a profit.

Helpful for:

Setting realistic sales targets and planning pricing.

How Often Should You Review the Profit & Loss Statement?

At a minimum:

- Monthly – Gives you regular insights and helps you catch issues early.

- Quarterly – For comparing trends and preparing for tax or financing.

- Annually – For overall performance review and strategic planning.

Tip: Use monthly reviews to make small tweaks, and quarterly reviews to assess strategy.

Why This Matters to You as a Small Business Owner

- Spot problems early – E.g. if profit is dropping but sales are stable, maybe costs are creeping up.

- Make better decisions – Pricing, hiring, expanding — all need financial insight.

- Stay in control – You’ll know whether the business is truly making money or just surviving.

- Communicate with confidence – When dealing with investors, banks, or even suppliers.

Automatic Reports, Smarter Decisions

You don’t need to worry about how to prepare cash flow statements—our solution does that for you automatically.

All you need is a clear understanding of what the numbers mean, so you can make confident decisions to manage and grow your business effectively.

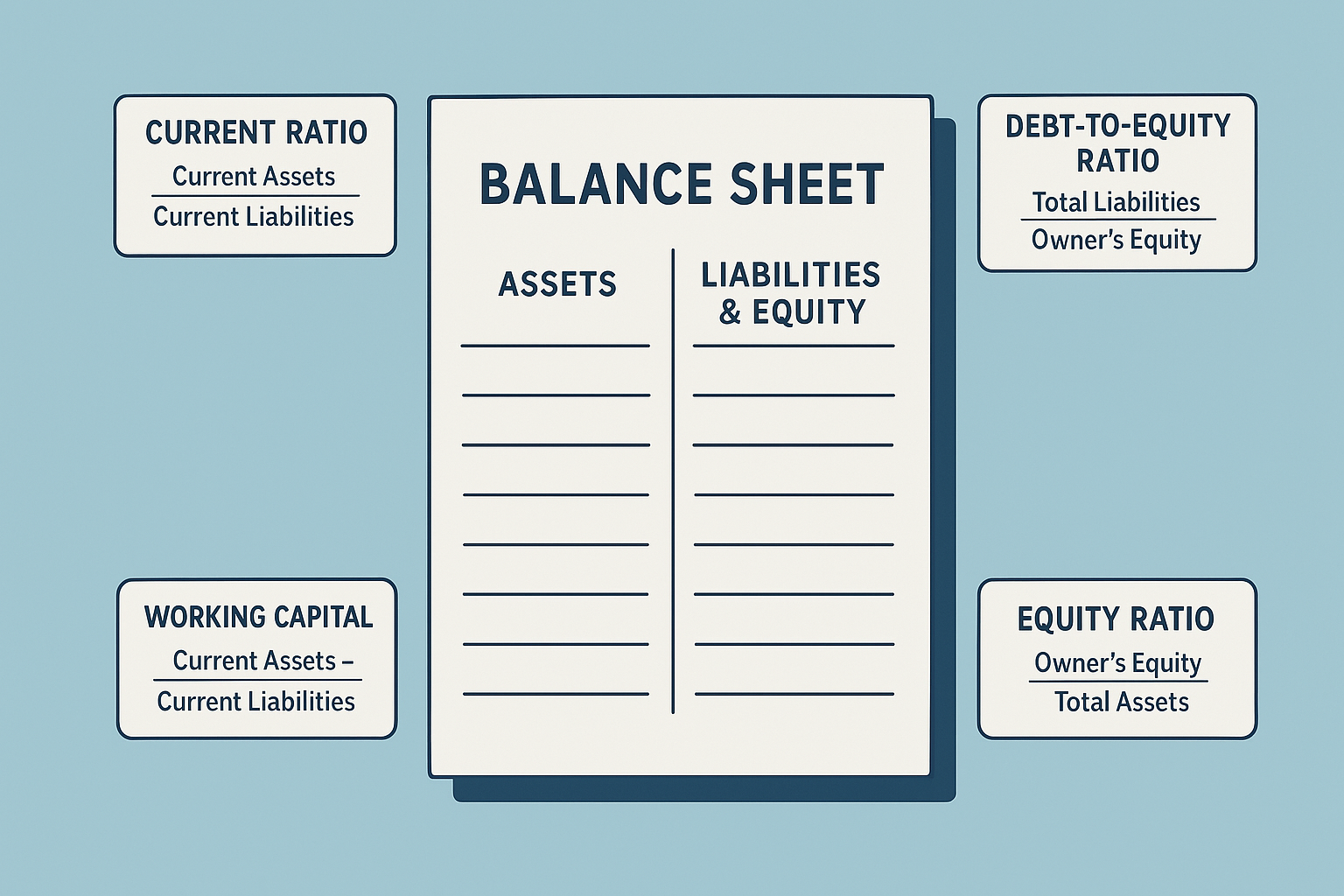

What is a Balance Sheet?

A Balance Sheet is a financial statement that shows your business’s financial position at a specific point in time. Think of it like a snapshot of what your business owns, owes, and how much is left for you (the owner).

Key Metrics Every Business Should Monitor for Success

Running a successful business requires more than just hard work and dedication—it demands a clear understanding of your financial and operational performance.

Key metrics, often referred to as Key Performance Indicators (KPIs), provide critical insights into your business’s health and help you make informed decisions..