This post is also available in:

Bahasa Malaysia

On 16th August 2023, Lembaga Hasil Dalam Negeri (LHDN) announced that e-Invoicing will be implemented in Malaysia.

e-Invoice requires all businesses to submit their invoices to LHDN for validation BEFORE sending it to their customer.

e-Invoicing implementation timeline

When do businesses need to comply with e-Invoicing?

e-Invoicing will be mandatory for all businesses and will be implemented in phases starting from August 2024.

Phase 1

1st August 2024

Businesses with annual turnover of RM100m or more

Phase 2

1st January 2025

Businesses with annual turnover of RM25m or more

Phase 3

1st July 2025

All other businesses.

In early July 2024, it was announced that businesses with annual turnover of RM150,000 or less will be exempted.

Update

On 20th Feb 2025, Datuk Seri Amir Hamzah Azizan, announced that the implementation of e-Invoicing for SMEs with annual sales of between RM150,00 and RM500,000 will be postponed to 1st Jan 2026.

Revised implementation timelines

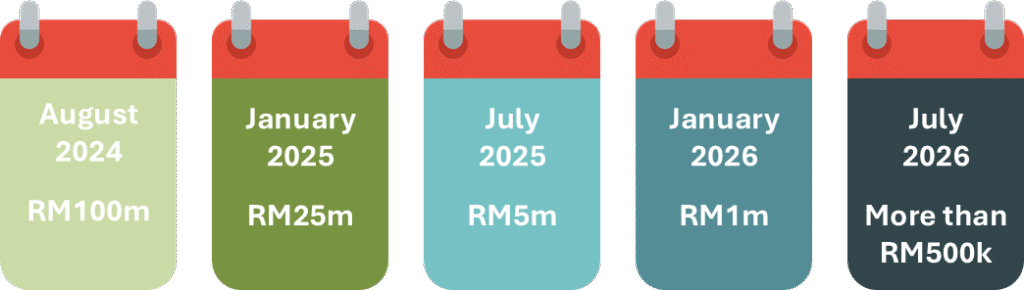

On 5th June 2025, LHDN revised the e-Invoice implementation timelines.

There are now 5 phases, starting from August 2024 for businesses with RM100m turnover or more, to July 2026, for businesses with turnover of RM500,000 or more.

Businesses with an annual turnover below RM500,000 have been currently exempted from the e-invoicing mandate. This exemption excludes businesses with subsidiaries or related companies with an annual turnover exceeding RM500.000 in 2022. Read more e-Invoicing Exemption for Businesses Under RM500,000 Turnover

Voluntary opt-in

Businesses may opt-in for e-Invoicing before the specified timelines if they prefer.

e-Invoicing interim relaxation period

Phase 1

August 2024

Businesses in phase 1, with an annual turnover of RM100m or more.

Interim relaxation period from 1st August 2024 to 31st January 2025.

Phase 2

January 2025

Businesses with turnover of RM25m or more.

Interim relaxation period from 1st January 2025 to 30th June 2025.

Phase 3

July 2025

All other businesses with turnover of RM150,000 or more.

Interim relaxation period from 1st July 2025 to 31st December 2025.

During the interim relaxation period, businesses:

- Are not obliged to issue e-Invoices even if requested by customers, instead, they can issue invoices as usual, but are required to submit consolidated e-Invoices by the 7th of the following month.

- Can submit consolidated self billed e-Invoices by the 7th of the following month

For consolidated e-Invoices, businesses need not provide a list of relevant invoice or receipt numbers in the description.

It’s important to note that this interim relaxation period does not mean e-Invoicing implementation has been deferred. Businesses must still comply by submitting consolidated invoices by the 7th of the following month.

How is turnover determined?

Turnover for e-Invoicing compliance is based on the reported income for 2022.

Audited accounts

If your accounts need to be audited, then turnover is based on the accounts for the financial year ended 2022.

If there has been a change in financial year, the turnover is to be pro-rated.

Tax returns

For businesses such as sole proprietors, partnerships, etc., where audited accounts are not required, the turnover is based on the tax returns submitted for the year of assessment 2022.

New businesses

If you are a newly setup business, where you do not have turnover for 2022, then you will need to comply with e-Invoicing from 1st July 2025.

Implications of non-compliance

Penalties

For the supplier, failure to submit affected transactions for validation can incur a penalty of RM20,000.00 per invoice.

Proof of cost and expenses

For customers who conduct business, purchases that have not been validated may be disallowed.

The invoice that your supplier sends to you must be validated for the expense to be allowed for tax purposes.