This post is also available in:

Bahasa Malaysia

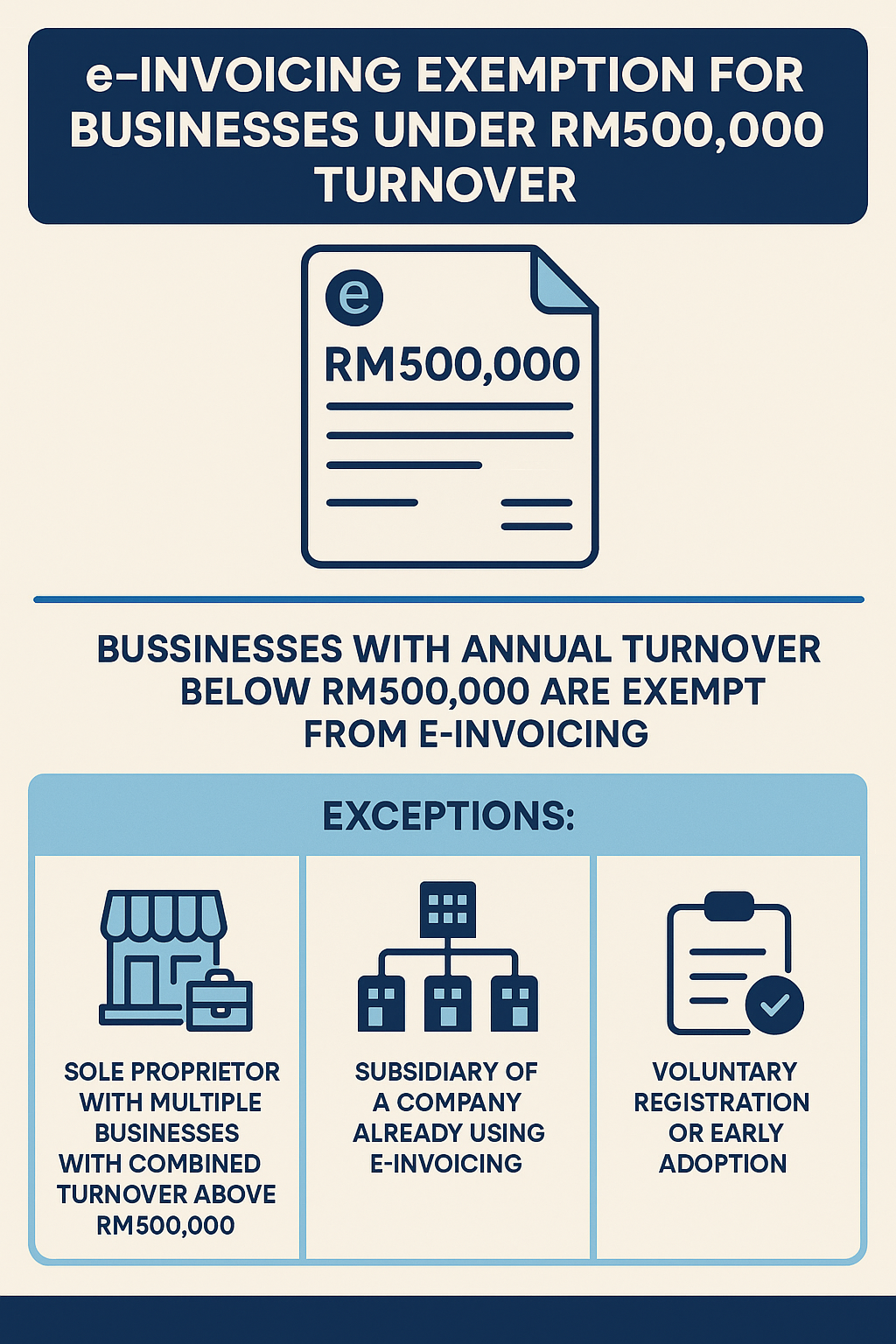

e-Invoicing Exemption for Businesses Under RM500,000 Turnover: What It Really Means

As Malaysia moves forward with mandatory e-Invoicing, many micro and small business owners are breathing a sigh of relief upon hearing that those with annual turnover under RM500,000 are exempt from e-Invoicing. But what does this exemption actually mean—and are there any exceptions to be aware of?

Let’s break it down.

What the Exemption Means

According to the Inland Revenue Board of Malaysia (LHDN), businesses with annual turnover or revenue below RM500,000 are not required to comply with e-Invoicing obligations, for now.

This is part of the government’s phased implementation approach, allowing smaller businesses more time to prepare or possibly remain exempt permanently, depending on future announcements.

This exemption applies to:

- Sole proprietorships

- Partnerships

- Private limited companies (Sdn Bhd)

- Limited liability partnerships (LLP)

- Associations or cooperatives

…as long as their total turnover is less than RM500,000 per annum.

Exceptions: When the Exemption May Not Apply

While the RM500,000 threshold seems simple, some scenarios may disqualify a business from this exemption, even if the individual entity’s revenue is below the limit. Here are some important exceptions to know:

1. Multiple Businesses Under One Owner

If you’re a sole proprietor who operates multiple businesses, LHDN may assess your combined turnover across all business entities.

Example:

Ahmad owns a nasi lemak stall and also runs a small online shop under two separate business registrations. Each business earns RM300,000 and RM250,000 respectively.

Total combined turnover: RM550,000.

Result: Ahmad may not be exempt, even though each business earns under RM500,000.

2. Group of Companies or Subsidiaries

If your business is part of a group of companies or is a subsidiary of a larger entity, the exemption might not apply depending on the group’s consolidated revenue or if the parent company has already been mandated to comply.

Example:

XYZ Sdn Bhd is a subsidiary of ABC Holdings Bhd, which has already implemented e-Invoicing under Phase 1 due to its high turnover.

Result: Even if XYZ Sdn Bhd has turnover below RM500,000, it may be required to comply due to its group association.

3. Voluntary Registration or Early Adoption

Some businesses may choose to adopt e-Invoicing voluntarily, even if they’re under the threshold, to stay ahead of compliance or for operational benefits. Once enrolled, compliance becomes mandatory for those entities.

How Is the RM500,000 Turnover Calculated?

The turnover figure is typically based on:

- The most recent audited financial statements, or

- For non-audited entities, self-declared figures in tax filings (e.g., Form B, P, C, or E)

LHDN may refer to the 2022 or 2023 tax year turnover to determine your obligation, depending on your implementation phase.

What Should You Do If You’re Near the Threshold?

If your turnover is close to RM500,000, it’s wise to:

- Track your revenue monthly

- Prepare for e-Invoicing in case you cross the threshold in the near future

- Speak to your accountant or tax advisor to assess your group structure or business connections

In summary

While the RM500,000 turnover exemption offers relief to many micro-enterprises and small traders, it’s important to look beyond the headline. Business structure, ownership, and associations can all affect your e-Invoicing obligations.

Need help determining if your business qualifies for the exemption or planning for future compliance? At Adventus Business Consult, we help businesses of all sizes understand and implement e-Invoicing in line with LHDN guidelines—without disruption to your operations.