This post is also available in:

Bahasa Malaysia

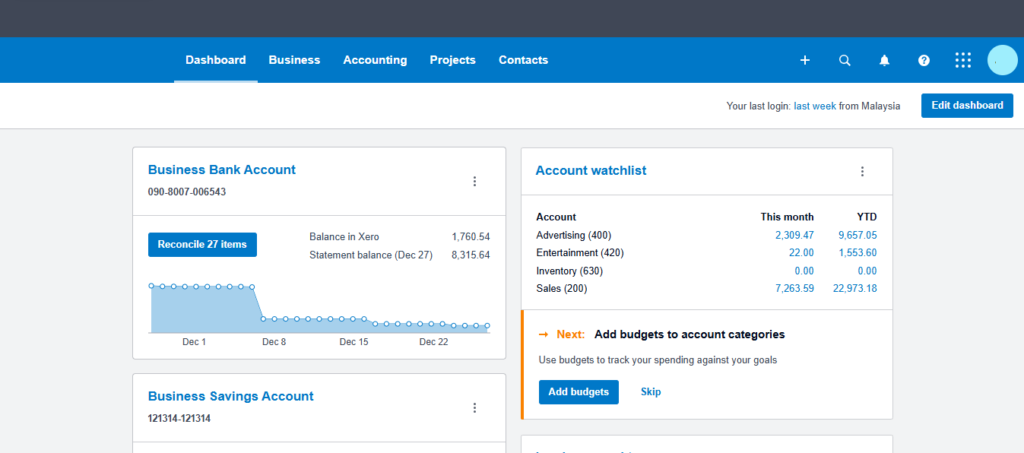

Xero is a cloud-based accounting platform designed to help small and medium-sized businesses manage their finances with ease. Known for its intuitive interface and seamless integrations, Xero offers a wide range of tools to streamline bookkeeping, financial reporting, and collaboration.

Key Features:

- Bank Reconciliation:

- Automatically imports and matches transactions from linked bank accounts.

- Simplifies reconciliation with intuitive tools to approve, categorize, or edit transactions.

- Invoicing and Payments:

- Allows users to create professional, customizable invoices.

- Supports online payment gateways like Stripe, PayPal, and Square for faster payments.

- Tracks invoice statuses to manage cash flow effectively.

- Expense and Bill Management:

- Tracks and categorizes business expenses in real time.

- Manages supplier bills and schedules payments to avoid late fees.

- Financial Reporting:

- Offers a variety of real-time reports, including profit and loss, balance sheet, and cash flow statements.

- Provides drill-down capabilities for deeper insights into business performance.

- Multi-Currency Support:

- Automatically updates exchange rates and calculates transactions in over 160 currencies.

- Ideal for businesses with international operations.

- Payroll Integration:

- Simplifies employee payments, tax deductions, and compliance with local regulations.

- Integrates seamlessly with Xero’s payroll solutions (where available).

- Third-Party Integrations:

- Connects with over 1,000 business apps, including inventory management, CRM, and e-commerce tools.

- Collaboration:

- Allows multiple users, including accountants and bookkeepers, to access real-time data with role-based permissions.

- Watchlist:

- Xero’s Watchlist feature is a tool designed to help businesses monitor the financial performance of specific accounts that are most critical to their operations.

Benefits:

- Cloud Accessibility: Access Xero from anywhere, on any device, ensuring flexibility for business owners and teams.

- Automation: Saves time with features like automated bank feeds, recurring invoices, and expense tracking.

- Customizable for Industries: Offers tools and integrations tailored for industries like retail, construction, and professional services.

- User-Friendly Interface: Easy to navigate, even for non-accountants, with clear visuals and intuitive workflows.

Who It’s For:

Xero is ideal for small to medium-sized businesses, startups, and freelancers who value simplicity, collaboration, and flexibility in managing their financial operations.

In summary, Xero is a powerful yet user-friendly accounting platform that simplifies financial management, making it easier for businesses to grow and thrive.

More on Xero

- Expense Management Made Simple with Xero

- Why Xero Works for Small Businesses in Malaysia

- Xero Business Snapshot: Your Financial Dashboard

- Xero Security: Protecting Your Financial Data

- Xero Syft: Smarter Accounting for Malaysian SMEs

- Xero’s Watchlist feature

- Xero and LHDN E-Invoicing: Preparing for Malaysia’s Phase 4 in 2026

- Xerocon Brisbane 2025: How Xero’s AI, Analytics, and Smarter Tools are Supercharging Small Businesses