Unlocking Financial Clarity with Xero’s Business Snapshot Dashboard

In today’s fast-paced business environment, having a clear, real-time view of your financial health is essential. Xero’s Business Snapshot feature offers just that—a powerful dashboard designed to help small businesses quickly assess their financial performance and make informed decisions.

What Is the Business Snapshot?

The Business Snapshot is a visual dashboard within Xero that consolidates key financial metrics into one easy-to-read interface. It’s designed for small businesses and their advisors to:

- Monitor profitability, income, and expenses

- Compare performance across different time periods

- Identify financial trends and risks

- Make strategic decisions with confidence

Whether you’re reviewing last month’s performance or comparing year-to-date figures against the previous year, the snapshot provides a comprehensive overview at a glance.

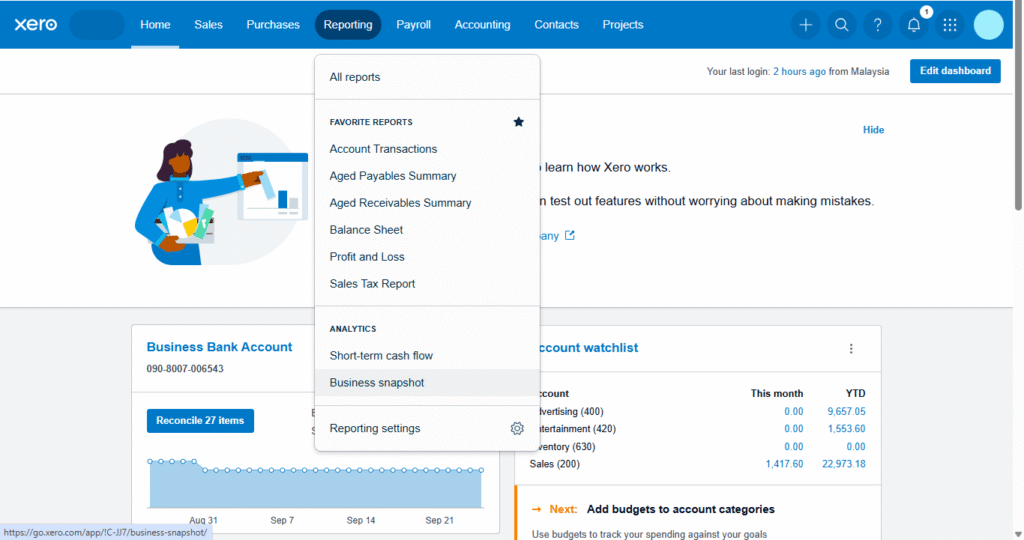

Business snapshot option is available in the Reporting menu.

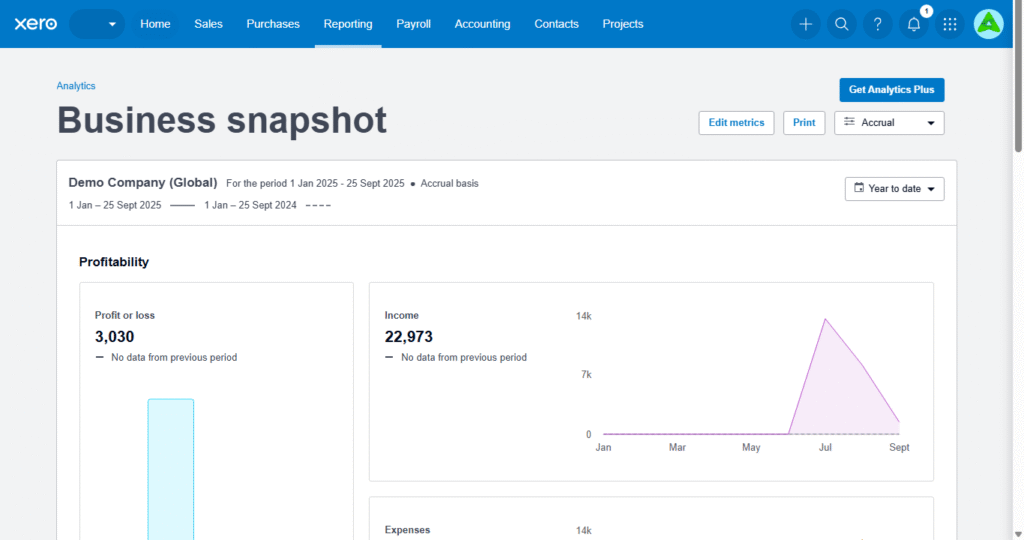

Key Features and Metrics

Here’s what you can expect from the Business Snapshot dashboard:

1. Profitability Insights

- Profit or Loss: Calculated as revenue minus expenses.

- Gross Profit Margin: Shows how much of your sales revenue remains after covering the cost of goods sold (COGS).

- Net Profit Margin: Reflects the percentage of revenue left after all expenses, including taxes.

2. Income and Expense Breakdown

- Income: Total earnings from products or services.

- Expenses: Includes COGS, operating expenses like rent, utilities, and depreciation.

- Top Expenses Table: Highlights the five largest expenses (customizable in Analytics Plus).

3. Balance Sheet Overview

- Assets: What your business owns (e.g., inventory, equipment, receivables).

- Liabilities: What your business owes (e.g., loans, payables).

- Equity: The net value of your business (assets minus liabilities).

4. Cash Flow and Payment Metrics

- Overall Cash Balance: Displays the total cash across your top three bank accounts.

- Average Time to Get Paid: Measures how long customers take to pay invoices.

- Average Time to Pay Suppliers: Tracks how quickly you settle bills.

5. Financial Ratios for Deeper Analysis

- Current Ratio: Assesses liquidity and ability to meet short-term obligations.

- Debt Ratio: Indicates how much of your assets are financed by debt.

- Debt to Equity Ratio: Evaluates financial stability and risk.

- Working Capital to Total Assets: Highlights potential cash flow issues.

- Fixed Assets to Net Worth: Reveals how much equity is tied up in fixed assets.

Advanced Features with Analytics Plus

For businesses subscribed to Xero Analytics Plus, the Business Snapshot becomes even more powerful:

- Customizable Metrics: Hide or show specific tiles to tailor the dashboard.

- Account Selection: Choose which accounts contribute to profitability and expense calculations.

- Advanced Financial Ratios: Add detailed ratio tables for deeper insights.

- Interactive Reporting: Click on figures to drill down into the underlying reports.

How to Use It Effectively

To get the most out of the Business Snapshot:

- Reconcile bank transactions regularly to ensure data accuracy.

- Collaborate with your accountant or advisor to interpret metrics and plan strategically.

- Customize the dashboard to focus on the metrics that matter most to your business.

Final Thoughts

Xero’s Business Snapshot is more than just a dashboard—it’s a decision-making tool that empowers small businesses to stay financially agile. By turning complex financial data into clear, actionable insights, it helps you understand where your business stands and where it’s headed.

Ready to take control of your financial future? Dive into your Business Snapshot in Xero today.

More on Xero

- Expense Management Made Simple with Xero

- Why Xero Works for Small Businesses in Malaysia

- Xero Security: Protecting Your Financial Data

- Xero Syft: Smarter Accounting for Malaysian SMEs

- Xero’s Watchlist feature

- Xero and LHDN E-Invoicing: Preparing for Malaysia’s Phase 4 in 2026

- Xerocon Brisbane 2025: How Xero’s AI, Analytics, and Smarter Tools are Supercharging Small Businesses