This post is also available in:

Bahasa Malaysia

Xero’s Watchlist feature is a tool within the accounting platform designed to help businesses monitor the financial performance of specific accounts that are most critical to their operations. Here’s a breakdown of its purpose and how it benefits businesses:

Purpose of Xero’s Watchlist Feature

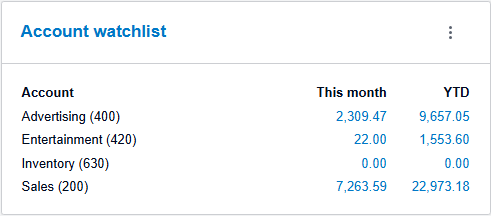

The Watchlist allows users to select key accounts from their chart of accounts to display prominently on their dashboard.

This feature ensures that business owners and financial managers can keep an eye on the financial metrics that matter most, such as income, expenses, or cash flow, without having to dive into detailed reports.

How the Watchlist Helps Businesses

- Real-Time Insights

- The Watchlist provides an at-a-glance view of the financial performance of selected accounts, updated in real time. This helps businesses make timely decisions based on their current financial position.

- Focus on Key Metrics

- Businesses can choose specific accounts (e.g., sales revenue, operating expenses, or a particular cost center) to track. This ensures that they stay focused on the areas that directly impact their financial health.

- Improved Financial Management

- By monitoring critical accounts daily, businesses can identify trends, spot anomalies, or address potential issues before they escalate, such as unexpected expense spikes or declining revenue.

- Time-Saving

- Instead of running multiple reports or navigating through different sections of the platform, the Watchlist consolidates essential financial data in one place, saving time and improving efficiency.

- Enhanced Decision-Making

- With key data readily visible, business owners and managers can make informed decisions quickly, whether it’s adjusting budgets, reallocating resources, or planning for growth.

- Customization for Relevance

- The Watchlist is customizable, allowing businesses to tailor the feature to their unique needs. For instance, a retail store might monitor inventory costs, while a service provider might focus on labor expenses.

Example in Action

For instance, a small cafe might use the Watchlist to track:

- Food and beverage costs to ensure they stay within budget.

- Daily sales revenue to monitor performance against targets.

- Utilities expenses to avoid unexpected cost increases.

By doing so, the cafe can quickly identify if costs are rising disproportionately to revenue and take corrective action.

In summary, Xero’s Watchlist feature helps businesses by providing a clear, real-time snapshot of their most important financial data.

This allows for better financial control, quicker decision-making, and ultimately, improved financial performance.

More on Xero

- Expense Management Made Simple with Xero

- Why Xero Works for Small Businesses in Malaysia

- Xero Business Snapshot: Your Financial Dashboard

- Xero Security: Protecting Your Financial Data

- Xero Syft: Smarter Accounting for Malaysian SMEs

- Xero and LHDN E-Invoicing: Preparing for Malaysia’s Phase 4 in 2026

- Xerocon Brisbane 2025: How Xero’s AI, Analytics, and Smarter Tools are Supercharging Small Businesses